So if the “active versus passive” debate isn’t really about “active” or “passive,” then what’s the issue?

John Bogle said it best:

“The conflict of interest in the industry isn’t about indexing vs. active management. It’s cost.”

And we agree. Passive buy-and-hold is not the holy grail. Neither is active investing. Maximizing your returns, net of fees, is our holy grail. – Meb Faber, No or Yes, Yes?

Meb is 100% correct. There is no holy grail to investment returns. In the end, all that matters is net of fee returns. (We are leaving taxes out of the equation for now). Fees necessarily decrease returns but that has to be weighed against the gross returns generated.

Of late, the target of the anti-fee crowd has been the private equity industry. Dale Folwell, the newly elected Treasurer of North Carolina is trying to simplify the state’s portfolio and reduce fees along the way. However there is a rub, alternative investments. Folwell states in a Bloomberg BusinessWeek article:

“We don’t own alternative investments. They own us,” Folwell says. “I think they increase complexity and reduce value.”

In another state, Calpers is looking for options to reduce the fees on its private equity portfolio. Calpers had a tough enough time trying to figure out what it was paying for its private equity exposure in the first place. Calpers has already taken an axe to its hedge fund portfolio in the name of saving on fees. Dan Primack writing at Fortune:

But the primary point remains: CalPERS crowing about savings in the absence of net return data is disingenuous, and particularly troubling given how its headline decisions are followed by other, smaller public pensions.

There is no doubt that hedge funds need to re-think their business model in light of lower gross and net returns. That being said, there are defenders of high-fee alternative assets. The most prominent, and vocal, being David Swensen at the Yale University endowment and author of Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment. In a recent report he took to task the anti-fee crowd. Swensen wrote:

“What Buffett, Gladwell and other fee bashers miss is that the important metric is net returns, not gross fees,’’ the report said. “Weak or negative returns would result in low or no performance-related fees, but would be a terrible outcome for the university…Performance-based compensation earned by external, active investment managers is a direct consequence of investment outperformance.’

Swensen acknowledges that simple, low cost, index-centric portfolios make sense for individuals and institutions that don’t have the capability to do the research and due diligence necessary to select active managers. However in the case of Yale it would have missed out on 13.6% annual returns from private equity if it had followed this approach.

There is a solid argument to be made that investors can pretty easily replicate private equity returns using publicly traded securities, leverage and some accounting revisions. Erik Stafford’s paper “Replicating Private Equity with Value Investing, Homemade Leverage, and Hold-to-Maturity Accounting” provides the road map. From the abstract:

Private equity funds tend to select relatively small firms with low EBITDA multiples. Publicly traded equities with these characteristics have high risk-adjusted returns after controlling for common factors typically associated with value stocks. Hold-to-maturity accounting of portfolio net asset value eliminates the majority of measured risk. A passive portfolio of small, low EBITDA multiple stocks with modest amounts of leverage and hold-to-maturity accounting of net asset value produces an unconditional return distribution that is highly consistent with that of the pre-fee aggregate private equity index. The passive replicating strategy represents an economically large improvement in risk- and liquidity-adjusted returns over direct allocations to private equity funds, which charge average fees of 6% per year.map.

Everyone recognizes that one of the downsides of investing in private equity (or venture capital) is illiquidity risk. Investors in these funds lock up their funds for years, sometimes in excess of a decade. In a world where we recognize the tendency of investors to flee for the hills at the first sign of trouble, illiquidity may be a feature not a bug. In short, a private equity replication may be in theory superior to the real thing, but in actuality would be misused by its owners.

There is no doubt that states, endowments and foundations would do well to closely scrutinize the fees they are currently paying for alternative assets. It would behoove the managers to be more transparent with their fee disclosures as well. Going forward investors should insist their managers more closely align their fees with the current reality.

Expected future 10-year US real stock returns:

Siegel 5%

Bogle 2%

Shiller 1%

GMO -4%Historical is 6.7%

— Meb Faber (@MebFaber) May 24, 2017

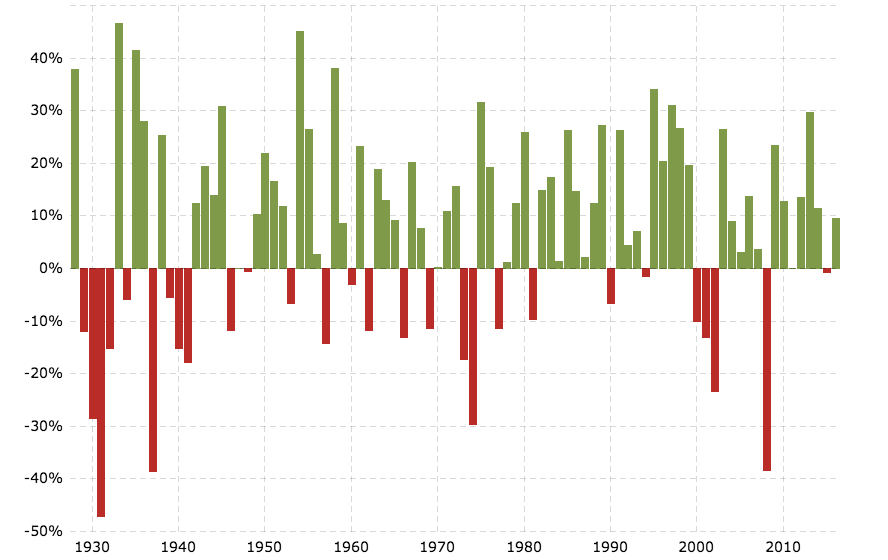

In a world of (at best) low single digit US real stock returns and a 2.38% 10-year US Treasury note it is not exactly clear where institutional investors are supposed to go to generate the returns their funds need to meet their obligations. The 1980s and 1990s are gone where double digit equity returns were the norm.

S&P 500 Index – 90 Year Historical Chart

It is all well and good to scrutinize fees and simplify a portfolio where possible. The private equity industry would do well to take recent criticism, on fees and governance, to heart. However reducing fees without taking into account the opportunity cost smacks of cutting off your nose to spite your face.