Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at ESG analytics.

Quote of the Day

"Asset management risk management seems to focus on the mapping of risk into a return-volatility or VaR framework and spends less time on the process."

(Mark Rzepczynski)

Chart of the Day

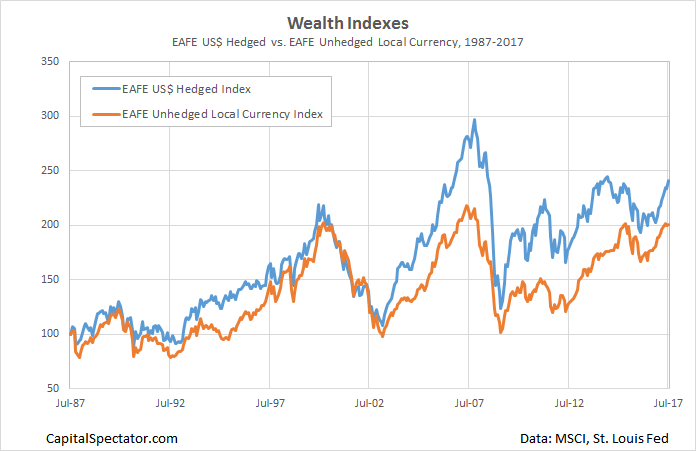

“The implication: foreign equity investing offers a bigger diversification bang for the buck by forgoing currency hedging.”

Bonds

- How the Fed's balance sheet affects the term premium. (papers.ssrn.com)

- Can bond portfolio returns be 'factorized'? (blog.alphaarchitect.com)

Corporate finance

- In what geographies are CEOs more willing to fudge the numbers? (wsj.com)

- PE-backed firms doubled down during the financial crisis. (papers.ssrn.com)

Momentum

- On the diversification benefits of time-series momentum. (blog.alphaarchitect.com)

- Why is absolute momentum on the no-go list for most managers? (dualmomentum.net)

Research

- Testing some US return anomalies overseas shows promise. (papers.ssrn.com)

- Who much money is in volatility-targeted strategies and should we be concerned? (mrzepczynski.blogspot.com)

- How investors should think about investing in quant strategies. (aqr.com)

- Why fund portfolios have become more liquid over time. (papers.ssrn.com)