Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at some of Scott Galloway’s ‘boring business advice.’

Quote of the Day

"So if you have a free ad supported service with a lot of regular power users, you should really consider adding a low priced subscription offering."

(Fred Wilson)

Chart of the Day

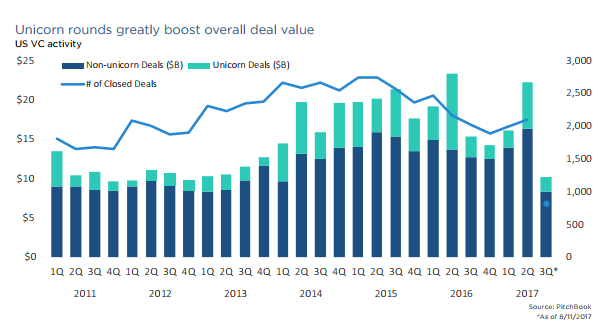

Financing unicorns has a big effect on overall industry fundraising numbers.

Ecosystems

- Austin and St. Louis are two cities thriving outside the Valley. (venturebeat.com)

- As Silicon Valley firms grow, residents are getting displaced. (ft.com)

- The coding bootcamp bubble has popped. (techcrunch.com)

VCs

- Three lessons learned from a first year VC. (collaborativefund.com)

- There are three sources of authentic differentiation for VCs. (medium.com)

- Investors can not be operators. (pointsandfigures.com)

- Unsolicited advice for an aspiring VC: go late. (medium.com)

- A quick, no, is a respectful no. (feld.com)

Founders

- What's the difference between an idea and a business? (linkedin.com)

- Building and maintaining a simple business model isn't easy. (awealthofcommonsense.com)

- The one question to ask founders on a Demo Day. (hunterwalk.com)

Startups

- Some hard learned lessons at the seed stage including the need to resist 'over-titling.' (linkedin.com)

- Pilot studies with big corporations are valuable but go in with the proper expectations. (medium.com)

- Venture capital is the new off-season hobby of NBA players. (bloomberg.com)

- Why seed funding declined in 2017. (medium.com)

- Customers hate MVPs. (blog.asmartbear.com)