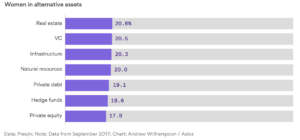

For better or worse the topic of gender inequity in finance and specifically investment management is not a new one. Recent data shows that women are significantly underrepresented in the alternative assets industry where 20% seems to be a ceiling more so than a floor. The results are worse when you look at who solely at who is actually making investment decisions.

Long-time readers of Abnormal Returns understand we have been writing about the issue of gender inequity in investment management, including in the FT for quite some time. Which is why I got irked at the lead-in to this FT article from a couple of weeks ago:

Hedge funds run by women have generated returns two times higher than their male counterparts this year, piling further pressure on a sector that has been branded “male, pale and stale” to recruit more female portfolio managers.

The returns the article discusses are for seven (7!$*?) months. You can’t say anything meaningful about performance over seven months, let alone seven years. What’s frustrating is that there is plenty of evidence showing that women are as good (or better) than their male counterparts in investment and business. Let’s look at some of the evidence:

- “Funds with all female managers perform no differently than all male-managed funds and have similar risk profiles.” (SSRN)

- “While numbers show that there appears to be no gender gap among Wall Street analysts (female analysts are as likely to be voted AAs as their male colleagues are), this paper finds that the factors driving success are not entirely the same between men and women.” (Alpha Architect)

- “Companies with a female founder performed 63% better than our investments with all-male founding teams.” (First Round Capital)

- “The tiny percentage of funds run solely by women performed essentially as well as those run just by men. More significantly, the study found that funds run by teams including both men and women had performed better than funds run solely by men or solely by women.” (Morningstar)

This is just a rough sampling of the research. Even more compelling is the research showing diversity (in general) can help make for better group decision making. Nor are investors seemingly biased against female-led funds. Don Phillips at Morningstar writes:

It’s worth noting that the lack of female fund managers cannot be blamed on the unwillingness of the public to accept women in such roles. A 2016 study led by Morningstar’s Madison Sargis found that having one or more women on a fund’s management team improved the odds that a new fund launch would attract enough assets to be successful. Clearly, the investing public will embrace female managers.

From a strictly profit-making it seems that hiring and promoting women works. A recent research study showed that male venture capitalists who had a daughter (or more) were more likely to hire female VCs. These more diverse teams seem to have better performance. From The Economist:

A firm where a partner has an extra daughter rather than an extra son had a 2.9% higher chance that its deals would be a success (defined as an initial public offering or other profitable sale of a company the firm had backed). Such firms also have higher internal rates of return. Hiring women is indeed a sound business strategy.

There is no magic bullet in the realm of fund management. Achieving above-market (and above-competitor) returns is not an easy task for everyone. That is why it is so puzzling that many managers fail to take the steps necessary to boost performance through diversity. As Richard Nesbitt co-author of Results at the Top: Using Gender Intelligence to Create Breakthrough Growth says it “shouldn’t take the birth of a daughter” to make for more diverse teams.