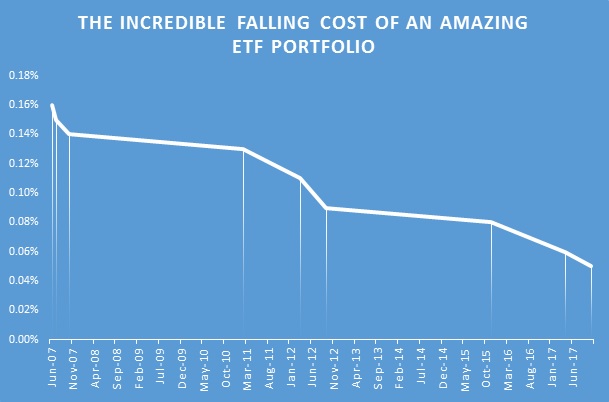

I have been noting with great interest the evolution of what Matt Hougan has called the “world’s cheapest ETF model portfolio” since its inception. The portfolio is built to include a globally diversified mix of ETFs. Back in 2007 this portfolio had a weighted expense ratio of 16 basis points. In a recent post at ETF.com Hougan notes this portfolio is now down to 5 basis points. Nor is the ongoing ETF price war going to end any time soon.

Now in absolute terms, 16 bp down to 5 bp, doesn’t seem like a lot, but it is. I would argue that entire robo-advisor, or automated portfolio solution business, would not exist were it not for cheap, index ETFs. There would not be pressure on the traditional mutual fund business to lower fees. The list goes on.

Sometimes it helps to take a step back and take in the breadth and depth of changes to the industry. As Hougan writes:

While there are things to worry about—the rise of ETF platform fees, liquidity and trading costs, market structure issues, etc.—let’s be clear: This is the best time to be an investor in the history of the world. For the first time, maybe ever, investors are paying fair fees and taking home the lion’s share of the market returns. And that’s a very, very good thing.

As Hougan notes there are always clouds on the horizon. Jack Bogle thinks Vanguard will soon be bumping up against some size constraints. I recently argued that simply building cheap portfolios isn’t enough to well-serve clients. But all in all, falling ETF expenses are indeed a ‘very good thing.’