Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why you should avoid dividend-related factors.

Quote of the Day

"The appeal of smart beta is easy to understand: it is cheaper than traditional actively managed funds, but as these strategies invest along an organising principle rather than just tracking an index like a classic passive fund, they appear to offer value for money."

(Jennifer Thompson)

Chart of the Day

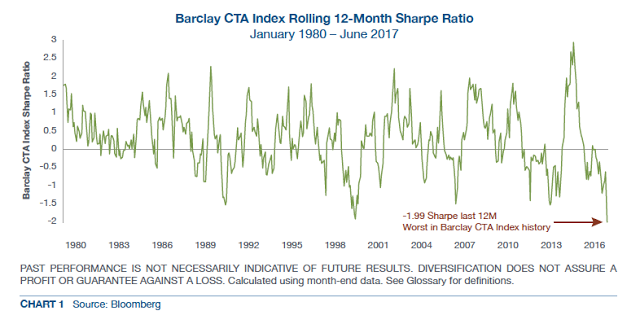

Will mean reversion kick in for managed futures returns?

Factors

- Do factor loadings or firm characteristics better explain portfolio returns? (alphaarchitect.com)

- How certain factors affect corporate bond returns. (etf.com)

- Why multi-factor portfolios perform better. (factorresearch.com)

- Five takeaways from the anomalies research. (blogs.wsj.com)

- The six sins of smart beta. (allaboutalpha.com)

Sponsored link

Valuations

- Are tech stocks to blame for the S&P 500's overvaluation? (gmo.com)

- Currently, a well-diversified portfolio largely shuns domestic equities. (researchaffiliates.com)

Research

- How to build asset class forecasts. (researchaffiliates.com)

- Hopping from one TAA strategy to another, based on relative strength, shockingly doesn't work. (allocatesmartly.com)

- If standard deviation is a poor proxy for the risk of an investment, what’s a better option? (portfoliocharts.com)

- More evidence that time-series momentum works. (etf.com)

- You should only pay high fees for high active share. (blog.thinknewfound.com)

- Do analysts fully adjust for seasonality in earnings? (alphaarchitect.com)

- The economics of PIPEs. (papers.ssrn.com)