Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at the overwhelming information flow VCs receive.

Quote of the Day

“I like to invest in people who reduce stress and avoid people who increase stress.”

(Mark Cuban)

Chart of the Day

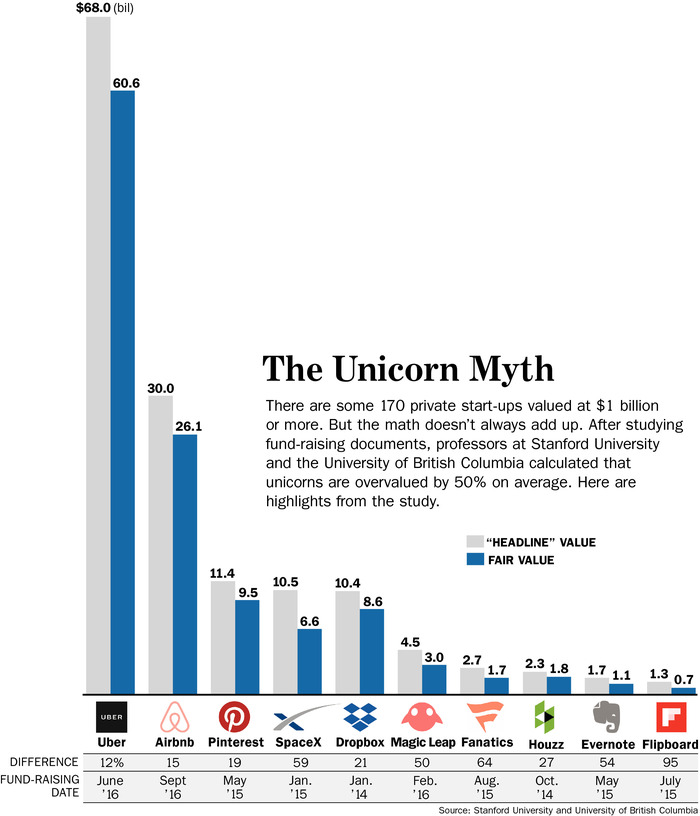

Measuring the value of so-called unicorns is trickier than it looks on first blush.

Seed stage

- Diligence 101 for seed stage startups. (medium.com)

- How to manage seed fundraising meetings. (hackernoon.com)

- Are there too many seed funds? (medium.com)

Free book

Venture

- First-time venture capital funds are on the rise. (wsj.com)

- Three ways to get a VC to move quicker than usual. (medium.com)

- The IPO pipeline is broken. How we could change the process. (pointsandfigures.com)

- How Midwest startups can more of a dollar of venture capital. (nytimes.com)

Companies

- Forget Google. DuckDuckGo is growing quite nicely. (avc.com)

- A startup, Hydros, wants to take on water filter giant Brita. (knowledge.wharton.upenn.edu)

- How Candid is trying disrupt what orthodontists do. (businessinsider.com)

Startups

- Is tech still solving important problems? (businessinsider.com)

- The transition from innovation to operations is a tricky one to traverse. (bothsidesofthetable.com)

- 'Disagree and commit' is a powerful notion. (tomtunguz.com)

- A deal isn't done until it is DONE. (onlyonceblog.com)

- Crowdfunders are not typical consumers. (medium.com)

- On the value of structured, anonymized feedback. (hunterwalk.com)