Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at why VCs are always asking ‘how big’ when thinking about a investment.

Quote of the Day

'The hard work of marketing, then, isn't promoting that thing you made. It's in building something where the Minimum Critical Mass is a low enough number that you can actually reach it."

(Seth Godin)

Chart of the Day

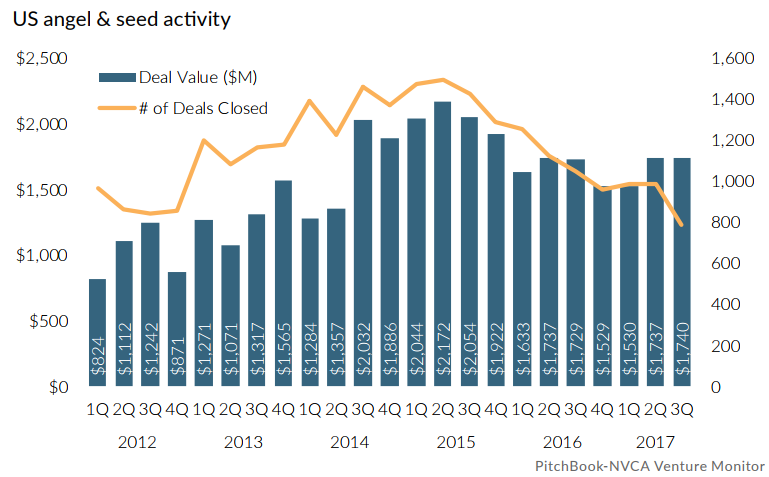

The seed and early stage investing market has cooled substantially in the past few years.

Coinbase

- Coinbase, as a company, is drinking water from a fire hose. (nytimes.com)

- Coinbase is the breakout startup of 2017. (blog.semilshah.com)

Knowledge

- This is a great tweetstorm of: "Things Many People Find Too Obvious To Have Told You Already." (twitter.com)

- Howard Lindzon talks 20 years of startup investing. (medium.com)

Profitability

- You can only build a company that last a generation if it actually makes money. (collaborativefund.com)

- Building a business from the get-go with revenue in mind. (medium.com)

- Founders need to ask themselves why they need outside capital in the first place. (om.co)

Venture capital

- Steve Case's Rise of the Rest has attracted an all-star cast of investors to bring venture capital to the Midwest. (nytimes.com)

- Not every big exit has VC behind it: the case of RXBAR. (chenmarkcapital.com)

- The differences between being a VC and a startup CEO are stark. (blog.midweststartups.com)

Startups

- First Round Capital's State of Startups 2017. (stateofstartups.firstround.com)

- Why founders need to recognize their own limitations. (codingvc.com)

- Every great pitch starts with a discrete change in the world. (medium.com)

- It's not enough to hire well. You have to onboard well too. (medium.com)

- Co-working spaces are not for everybody. (ft.com)