Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at Morningstar’s analyst ratings.

Quote of the Day

"So it’s very difficult to spot a bubble that is going to pop, because the bubble may continue and you’ll then lose out from having engaged in what’s still a variety of market timing."

(Ellroy Dimson)

Chart of the Day

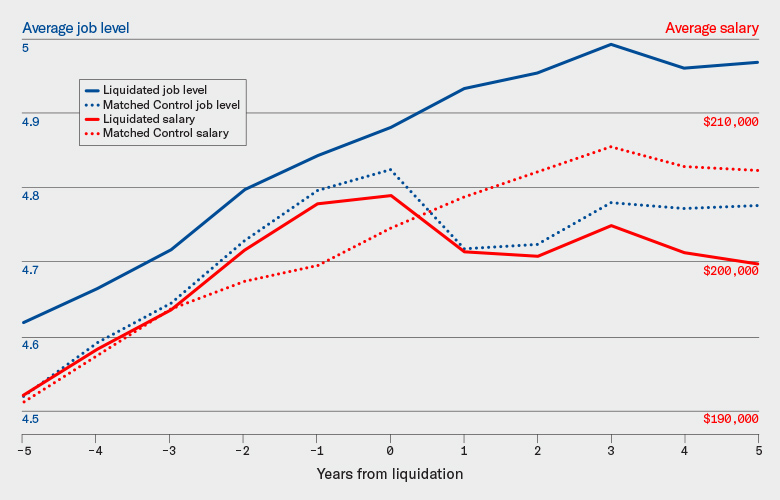

When hedge funds blow up, they tend to inflict lasting damage on managers’ careers, research has shown.

Research links

- Value investing with permanent sector under/overweights is a mistake. (blog.thinknewfound.com)

- Deep value represents an opportunity. The challenge is pulling the trigger. (alphaarchitect.com)

- Is gold really all that great an inflation hedge? (pensionpartners.com)

- Why the mathematics of market timing doesn't work. (arxiv.org)

- Some preliminary insights into cryptocurrencies as an asset class. (cxoadvisory.com)

- What's behind the falling number of public companies in the US? (advisors.vanguard.com)

- Tyler Cowen thinks this is "one of the best and most interesting papers of the year." (marginalrevolution.com)