Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the many ways backtests can go bad.

Chart of the Day

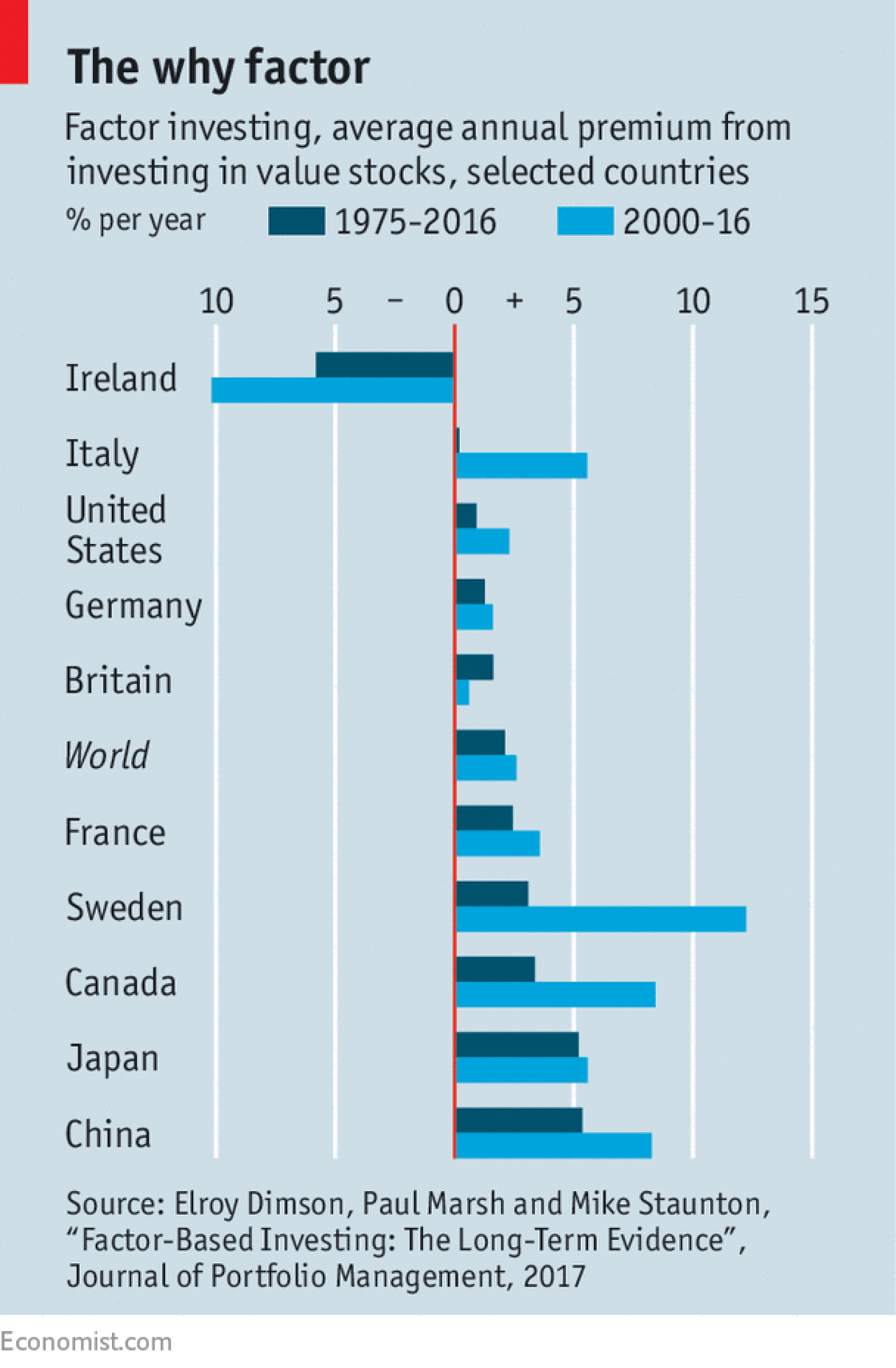

“Still, the best-known factors have been too successful for too long for it to be a statistical quirk.”

Trend

- How often does a simple trend following system outperform the standard 60/40 portfolio? (econompicdata.blogspot.com)

- What to expect from TAA strategies during a bear market. (allocatesmartly.com)

- How to avoid three traps of momentum investing. (quantpedia.com)

Oddities

- It's hard to understand just how skewed US companies are size-wise. (crossingwallstreet.com)

- All of the S&P 500's gains since 1993 have occurred while the market was closed overnight. (nytimes.com)

- Why you should select a fund manager who was among the oldest in their school class. (wsj.com)

Research

- A decomposition of low US stock volatility. (fiduciary-matters.russellinvestments.com)

- Factor investing should work in fixed income. (alphaarchitect.com)

- How to leverage a 60/40 portfolio by using ETFs not leverage. (blog.thinknewfound.com)

- A look at a put-write strategy with the Russell 2000. (wisdomtree.com)

- Why focus on the best (or worst) performing sectors when you can buy them both? (wsj.com)

- 10 steps to becoming a better quant. (cxoadvisory.com)