Driven by rave reviews, sophisticated consumers, marketing genius and tourism, Japanese whisky sales are glugging away at a pace far higher than expected at the turn of the millennium, when what are now hit products were being distilled and barrelled. Stocks of the most popular lines are down to vapours.

Leo Lewis in the FT notes how decisions made by the big Japanese whiskey makers nearly two decades ago is affecting their business, negatively today. Just as these world-class whiskeys take time, other fantastic outcomes also take time. The challenge is that we often don’t even know we are setting ourselves for failure in the moment.

Nick Maggiulli at Dollars and Data attributes many of our challenges to our inability to put in the time and effort to generate good stuff:

I tell you this because you have to remember to focus on the long term in a world that has become used to having everything now. Whether its your career, your family, your health, or anything else worthwhile, take a step back and realize that it takes time.

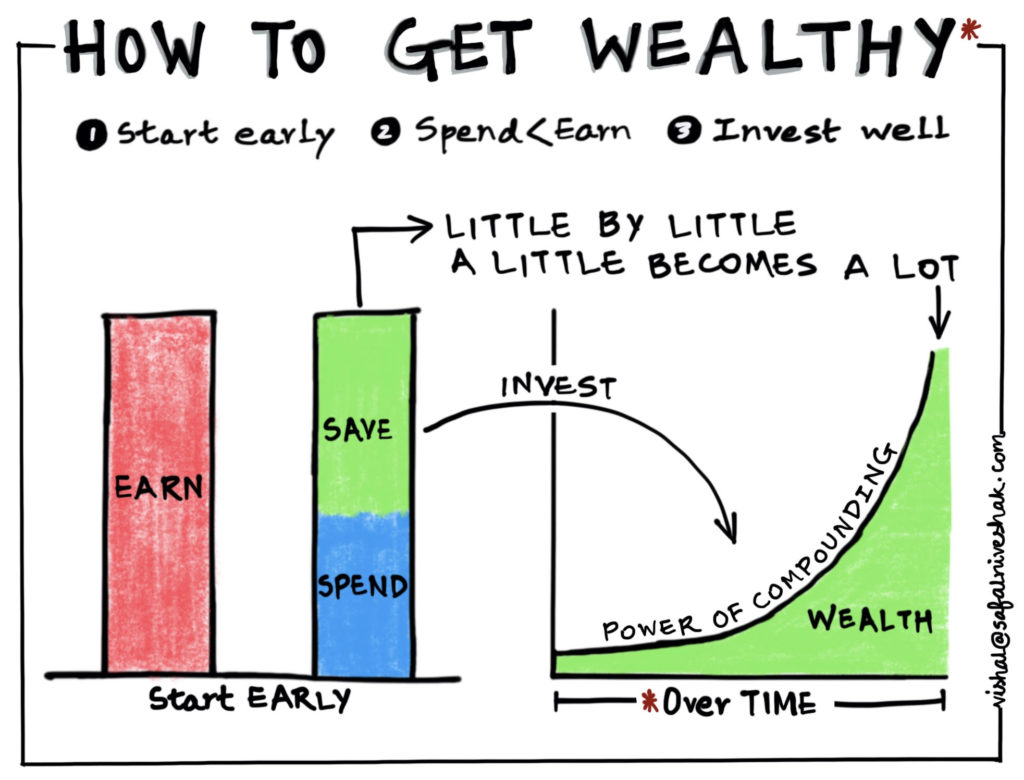

After a moment of thought, this makes sense. The graphic below by Vishal Khandelwal at Safal Niveshak clearly demonstrates the importance of time and compounding on building wealth.

If it were this easy, we would all do it. Katie Nixon, CIO at Northern Trust Wealth Management, emphasizes this point in an interview at Business Insider:

“It’s the most powerful answer I can give, and that is, save as much as you can as early as you can..Start saving and enjoy the benefits of the eighth wonder of the world, which is compound interest.”

But we know that isn’t the case. Most adults don’t save (or can’t) and find themselves having to catch up as retirement nears. Part of the problem is that our intuition about compounding is not all that great. Michael Batnick at the Irrelevant Investor notes how this can lead investors to take on too much risk in order to make up for those missed early saving/investing opportunities.

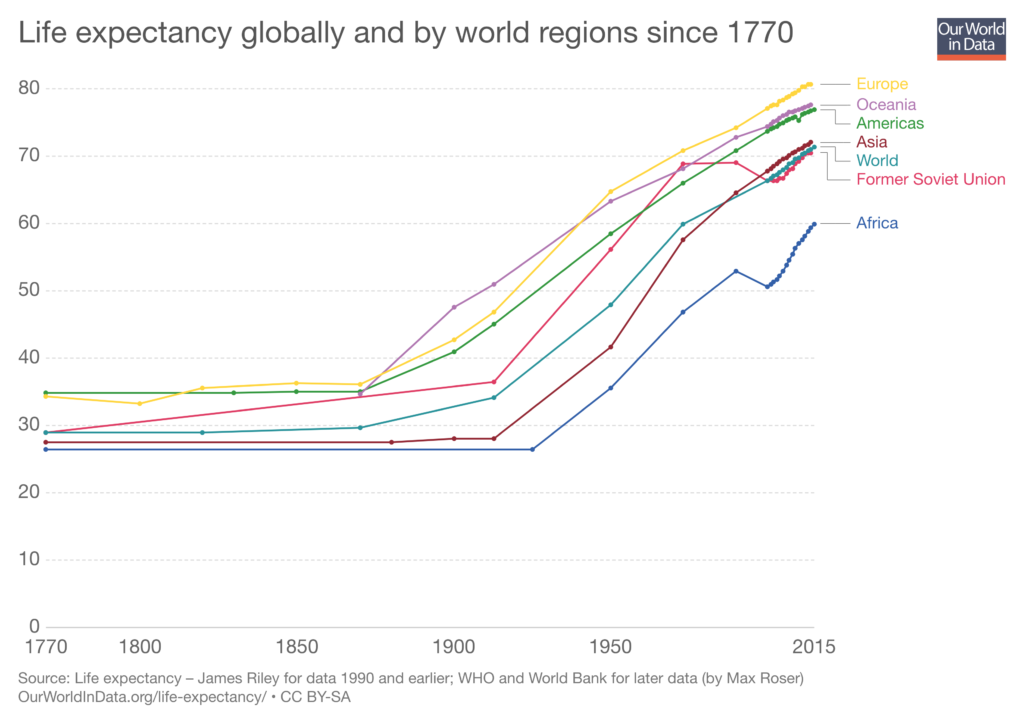

My half-baked thesis isn’t that we humans are necessarily bad at math. My thesis is that our intuition hasn’t caught yet caught up the modern increase in life expectancy. You can see below how lifetimes, long enough to even consider anything like retirement, are a last-century phenomenon.

Source: Our World in Data

Said another way, for most of our existence, humans didn’t have the luxury of time to enjoy the power of compounding in our own lifetimes. We can, of course, try to educate everyone about the power of saving (and compounding). However, the track record of financial literacy efforts are mixed, at best.

An alternative may be a mandatory savings program, like Australia, already has in place. In an ideal world we wouldn’t have to nudge people that hard to save, but until our intuition catches up to our modern reality, it may be the only solution to save us from our relatively immature brains.