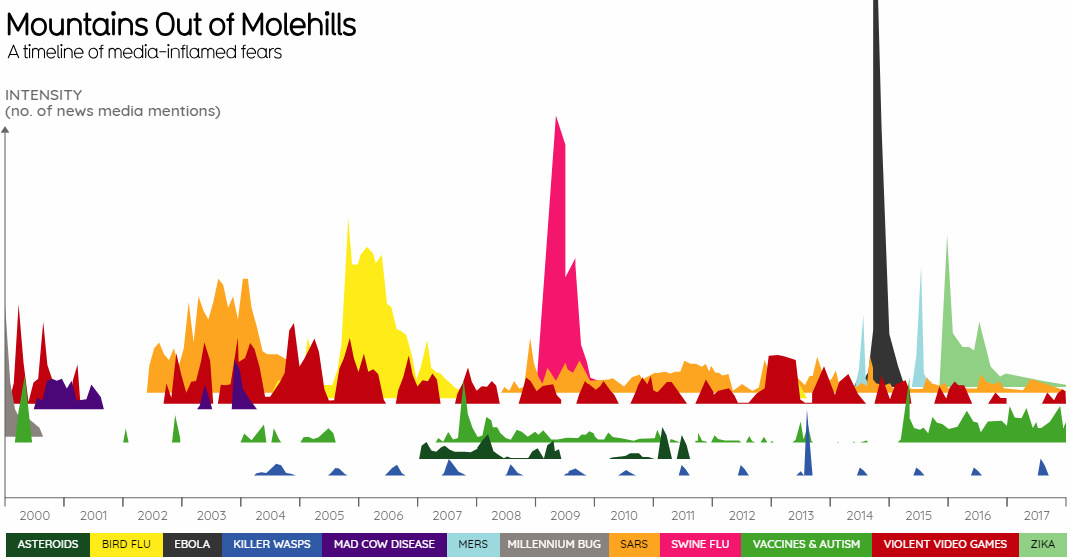

The chart below from the Visual Capitalist blog illustrates one reason why the media is held in such disregard of late: hype. The chart shows the many things the media touted over the past 20 years that was going to kill us all. As Jeff Desjardins notes:

“While having zero deaths is certainly the ideal, and many of the issues above should be taken very seriously especially as stories develop, we should be careful not to blow things out of proportion. Making mountains out of molehills does not help anyone, and it adds to growing distrust of media in general.”

We need the media to help keep us informed. The challenge is recognizing when the echo chamber has gone into overdrive. As Morgan Housel at Collaborative Fund writes:

“Gathering information is a science. Filtering out noise is an art.”

The investing term ‘active vs. passive‘ has gotten overused in the financial media. However the framework is useful when thinking about how we consume media. We have to be active, critical consumers lest we allow the media to drive our thinking. Passive consumption is a road to frustration and anger. In short, don’t let the media play you. As I wrote in a post a little while ago.

“We can however choose to engage the financial news on our own terms. Those terms should include a knowledge of how the game is played and how not to get played in the process.”

There may come a day when some unexpected plague comes for us all. At that time the last thing you will be worried about is your portfolio.