I was recently asked my definition of smart beta. My definition of smart beta includes every strategy that does not reflect market capitalization weights. Taken to it extreme you could say holding anything other than the global market portfolio is some form of active investing. That fact is that almost no one holds this portfolio, so we are all in a sense active investors. Which is okay.

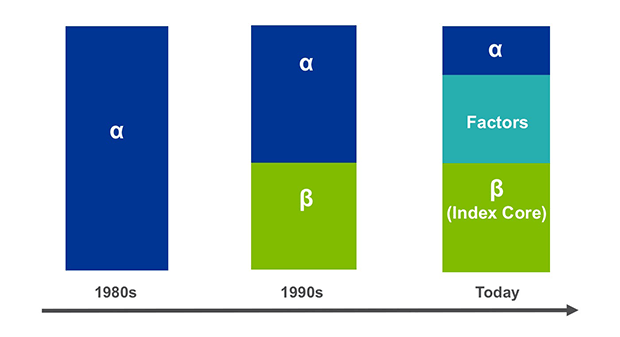

It used to be the case that active portfolio management was the default investment style. Over time, and with the help of academic finance, we have come to realize that there are other factors at work. The most obvious of which is the market factor or beta. It is this insight that underlies the rise in index investing. A trend which by all accounts is still in place.

A recent article by Robin Wigglesworth in the FT talks about how factor investing is disrupting the hedge fund industry. Wigglesworth writes:

“Think of factors as the basic ingredients of a solid meal. By deconstructing and finding the healthiest components, fans say they can be reassembled into a better-balanced, tastier diet. In other words, a more diversified, robust and cheaper investment portfolio than one built with traditional, blunt asset classes like stocks and bonds.”

While true, factors really are just working hypotheses on how the market actually works. In short, there’s nothing to say that these factors are in any real sense true or right. Future data can, and will, show other factors to be more powerful or explanatory.

This can be true because these factors get subsumed by some other measure. Or market participants adjust to the factor and remove whatever profitable explanatory power it once had. The challenge for investors is recognizing which of these two cases hold. In either event a factor that once held sway, no longer does. At the current time, think about the demise of price-to-book as a indicator of value.

If you think about this shouldn’t be all that surprising. Very little in the world stays static over time. Why should we think that statistical artifacts, like factors, should remain stable? As David Harding at Winton said in regard to his firm’s de-emphasizing its trend following program said:

“There are no laws of finance. Many people in finance seem to be trying to treat it as a physical science. This is a mistaken approach. Their philosophy is wrong.”

Much of the growth in the ETF industry of late has been built on smart beta or factor ETFs. Let’s leave aside the issue that many factor ETFs are a long-only version of what in the academic data is a long-short strategy. The history of these products has been one of repeated disappointment. Firm’s are now willing and able to launch a new index ETF based upon a favorable backtest. These backtests are at-risk of being overfit. Ergo, disappointment. Leaving these criticisms aside, why should we expect these ETFs to perform well in the future?

As investors it is like we are trying to wend our way through a darkened room without banging into something. We all know the future will look different than the past, the challenge is knowing in which ways it will differ. Quantitative or factor investing is at its heart a bet that the future will resemble the past. Historically that condition holds, for some indeterminate amount of time. The challenge for all investors is knowing when the past has lost its power to tell us anything about the future.