Mondays are all about financial adviser-related links here at Abnormal Returns. You can check out last week’s links including a look at the importance of a ‘client focused mindset.’

Quote of the Day

"SPDRs is unique among the top ETF providers in that they are the only player not currently competing with their own best customers. Vanguard, BlackRock, Fidelity and Schwab are all aggressively marketing their own robo-advice platforms..."

(Josh Brown)

Chart of the Day

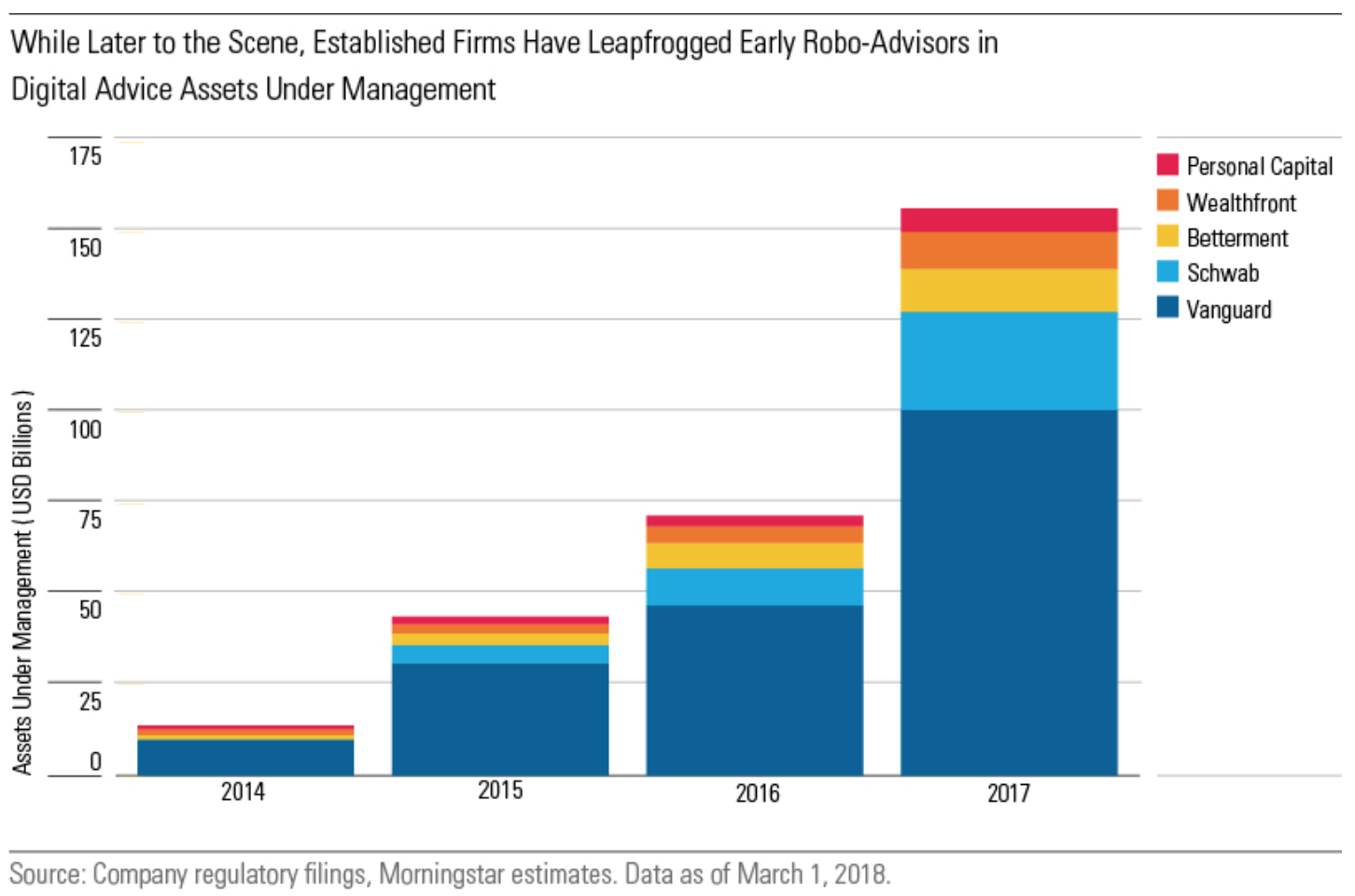

The early robo-advisors have been leapfrogged by established firms.

Advice

- Roger Nusbaum, "I would push back on an advisor's goal to outperform the market. As an advisor, my first priority is that clients can maintain a reasonable lifestyle (reasonable in relation to their career earnings). My next priority is to do all I can to make sure clients don't succumb to their emotions." (themaven.net)

- The top robo-advisors ranked per Barron's. (barrons.com)

- Financial advisers are slowly backing away from mutual funds and active strategies in favor of ETFs. (kitces.com)

- The big banks are courting the next generation of wealth families. (bloomberg.com)

- How to find the next generation of financial advisers. (wealthmanagement.com)

- How Meg Bartlet built niche advisory firm Flow Financial Planning over the past two years. (kitces.com)

- Couples financial counseling is now a thing. (melmagazine.com)

- Why nobody reads broker disclosure forms. (blogs.wsj.com)

Podcasts

- Carl Richards talks with Greg Davies about the value of the financial planning process. (advicereinvented.com)

- Barry Ritholtz on the need for financial advice. (ritholtz.com)

- Can you mix Bitcoin with financial advice? Josh Brown talks with Tyrone Ross of Noble Bridge Partners. (thereformedbroker.com)

- Michael Kitces talks with Matthew Blocki about how he built his niche advisory business. (kitces.com)