Subscribe! Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"One of the surprising things this blog has taught me is how long it takes Reality to go viral. There are entrenched interests opposed to the Truth; they release their grip on their subjective fantasies very, very slowly."

(Barry Ritholtz)

Chart of the Day

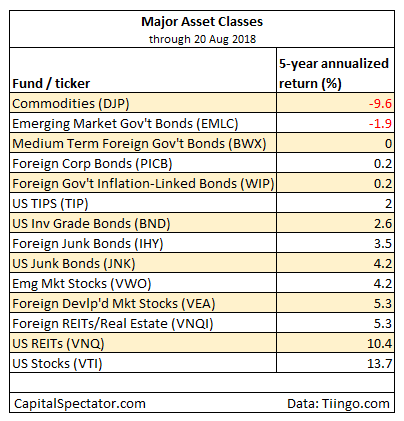

The major asset classes that performed the worst over the past five years.

Markets

- The muni bond yield curve is not all that flat. (bloomberg.com)

- Traders HATE coffee futures. (topdowncharts.com)

Strategy

- People like to make small changes to their portfolios to avoid regret. (wsj.com)

- Why forecasting 7-year returns is so difficult in practice. (awealthofcommonsense.com)

- Investment superstitions are silly but here are some maxims you should heed. (blairbellecurve.com)

Companies

- What is the optimal reporting period for corporate earnings? (bloomberg.com)

- Why more corporate transparency is better than less. (albertbridgecapital.com)

Tesla

- What if Elon Musk is doing exactly what he needs to do? (scheplick.com)

- When your suppliers are worried about getting paid you have a problem. (wsj.com)

Finance

- JP Morgan ($JPM) is getting into the free stock trading game. (cnbc.com)

- Why bank tellers aren't going away any time soon. (bloomberg.com)

Funds

Global

Economy

- Tim Duy, "We are moving towards a different point in the cycle where you are closer to neutral and the Fed has to make some harder decisions." (ft.com)

- The secular case for higher inflation: demographics. (calculatedriskblog.com)

- Mortgage rates are trading in a range. (calculatedriskblog.com)

- Increasing industry concentration is holding down wages. (ft.com)

Earlier on Abnormal Returns

- Research links: diversified diversifiers. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: changing goals. (abnormalreturns.com)

- ESG links: not-so green bonds. (abnormalreturns.com)