Mondays are all about financial adviser-related links here at Abnormal Returns. You can check out last week’s links including a look at how to deal with constantly shifting client goals.

Quote of the Day

"There are thousands of financial advisors doing the right thing by their clients, but it’s the bad actors that make the headlines. Unfortunately, fraud, theft, and greed make for great stories while compassion, integrity, and ethics do not."

(Michael Batnick)

Chart of the Day

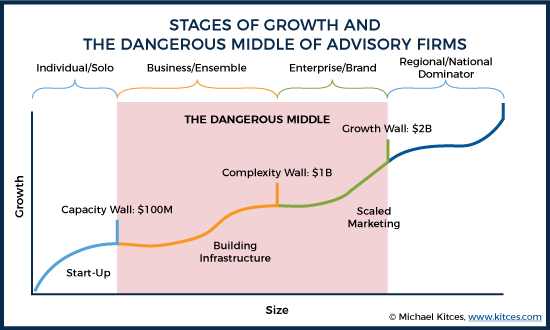

When advisory firms are between $100 million and $2 billion in AUM they are in the ‘dangerous middle.’

Aging clients

- Some signs of elder financial abuse. (schwab.com)

- How does aging affect financial decision-making? A discussion with Brie Williams, V.P. of State Street Global Advisors & Head of Practice Management for the Global SPDR Business, discusses the financial implications of cognitive decline. (etfstore.com)

- Elderly clients are uniquely at-risk of account churning by brokers. (nytimes.com)

- How organizing consultants can help clients help downsize their homes. (washingtonpost.com)

Understanding

- A great question to ask clients: "Do you want our advice or our support?" (fa-mag.com)

- Why advisors need to be cognizant of differential cultures among clients. (onefpa.org)

- Is your client a stock or a bond? And why their portfolio should reflect it. (economist.com)

- Bragging and financial advice don't go well together. (marketwatch.com)

Incentives

- It's hard to overcome the distortions from commission-based compensation systems. (prestondmcswain.com)

- The story about these two advisors could not be more stark. (allaboutyourbenjamins.com)

Advisers

- Commission-free trades are great but they are no substitute for a well thought out portfolio process. (allaboutyourbenjamins.com)

- Robo-advisors are trying to become full-fledged 'financial wellness systems.' (financial-planning.com)

- How account size affects the incremental value of asset location. (thefinancebuff.com)

- 40% of defined contribution plan participants who own a TDF own another fund as well. (vanguardinstitutionalblog.com)

- A financial plan isn't complete without a will. (nextavenue.org)