Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"A single indicator doesn’t tell you anything."

(Michael Batnick)

Chart of the Day

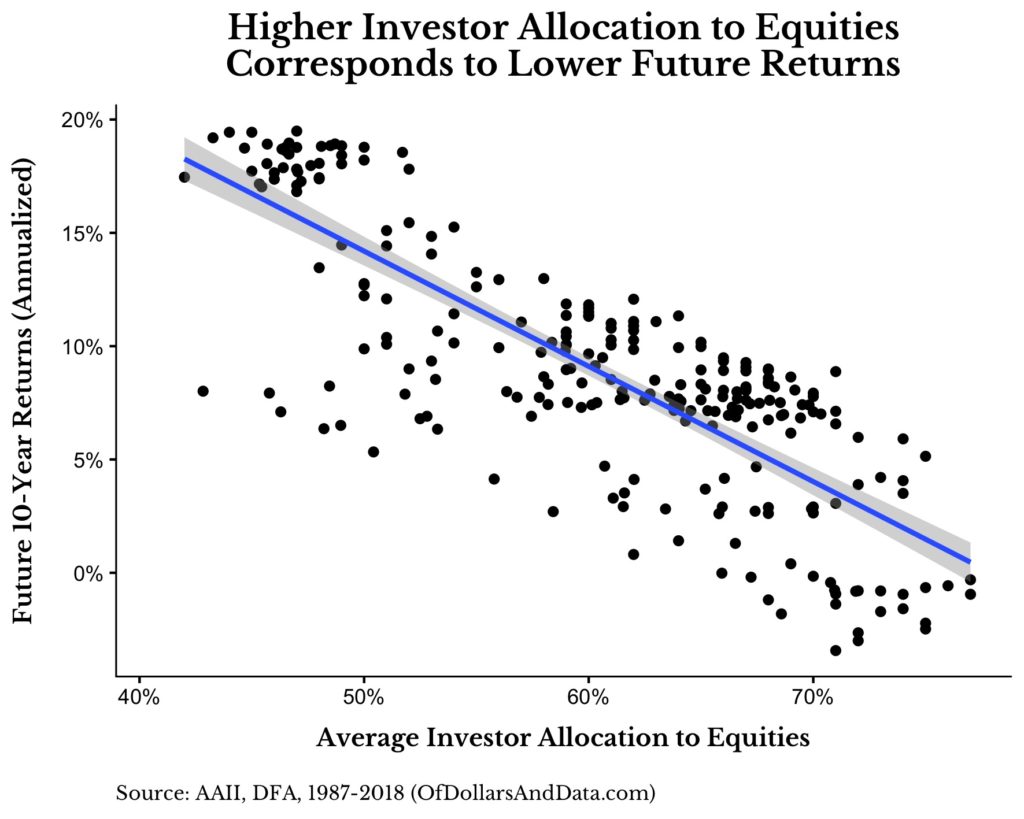

Historically higher investor allocations to equities have been associated with lower future returns.

Markets

- THIS is the big factor that analysts have missed throughout this bull market. (morningstar.com)

- A list of the twenty worst performing assets over the past five years includes a lot of commodities. (capitalspectator.com)

- Lumber prices are now down year-over-year. (calculatedriskblog.com)

Rates

- This is an interesting way to frame the risk in the 10-year Treasury. (integratinginvestor.com)

- Making the someday case for bonds. (awealthofcommonsense.com)

Strategy

- What we can learn about the herd mentality of investors from actual herds. (therealwealthfarmer.com)

- How to invest in a low secular growth world. (mrzepczynski.blogspot.com)

Crypto

Finance

Funds

- "The rise of passive investments has had a substantial impact on active managers — not to mention their research providers." (institutionalinvestor.com)

- The hedge fund industry needs a good bear market and/or fewer managers. (bloomberg.com)

- Another week, another scad of high profile hedge funds are closing. (wsj.com)

Global

- The winners and losers of $100 oil. (ftalphaville.ft.com)

- Where real estate is most expensive around the world. (visualcapitalist.com)

Economy

- Small business owners are having a hard time hiring workers. (disciplinedinvesting.blogspot.com)

- Fed chairman as chief scold. (crossingwallstreet.com)

Earlier on Abnormal Returns

- Research links: micro factors. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: admiration and concern. (abnormalreturns.com)