Wednesday is all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at the economics of retiring to Spain.

Quote of the Day

"The real way that people get rich is by spending way less than they earn, and this can only be accomplished by controlling the large fixed costs like your rent/mortgage and car payments. I’m all for finding ways to save more money, but if you can’t control the big costs, the small ones won’t matter."

(Michael Batnick)

Chart of the Day

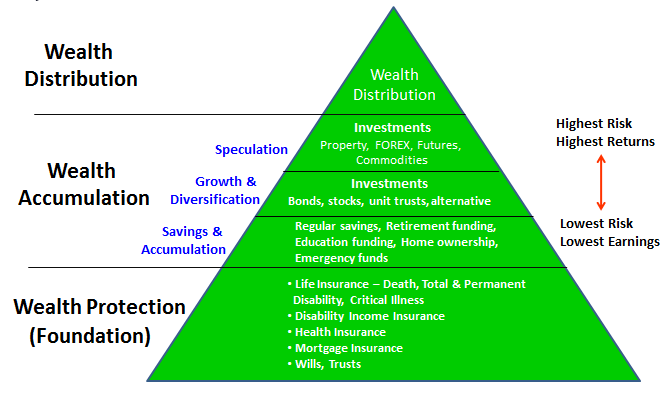

There’s a lot of similarities in building a home and strategic financial planning.

529 plans

- The best 529 college savings plans for 2018. (morningstar.com)

- How to open a 529 plan. (petetheplanner.com)

- 529 plans are no panacea but not using them can leave money on the table. (morningstar.com)

Investing

- Three questions that help put your portfolio into perspective during stressful times. (humbledollar.com)

- Calendar years are an arbitrary measure of your portfolio returns. (blairbellecurve.com)

Spending

- Mindful spending is a virtue. However economic inequality can make that difficult for many. (getrichslowly.org)

- Roger Nusbaum, "Every aspect of your financial life will be easier once you can get to the point of living below your means." (moneymaven.io)

- When should you pay up for quality and when should you economize? (getrichslowly.org)

Real estate

- Should you hold your rental properties in a LLC? (whitecoatinvestor.com)

- Baby boomers want to stay in their homes as long as they can. (wsj.com)

- The wealthiest Americans own business and other people's homes. (washingtonpost.com)

Personal finance

- The downsides of whole life insurance are many. (whitecoatinvestor.com)

- Estate planning is not just for the rich. (realsmartica.com)

- How does a stepped-up basis benefit you? (humbledollar.com)

- Like death and taxes, RMDs are inevitable. (morningstar.com)

- Ben Carlson, "Money and career are important but they’re not everything." (awealthofcommonsense.com)