Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"Boredom begets action, and it’s usually less-than-well-considered action."

(Ben Hunt)

Chart of the Day

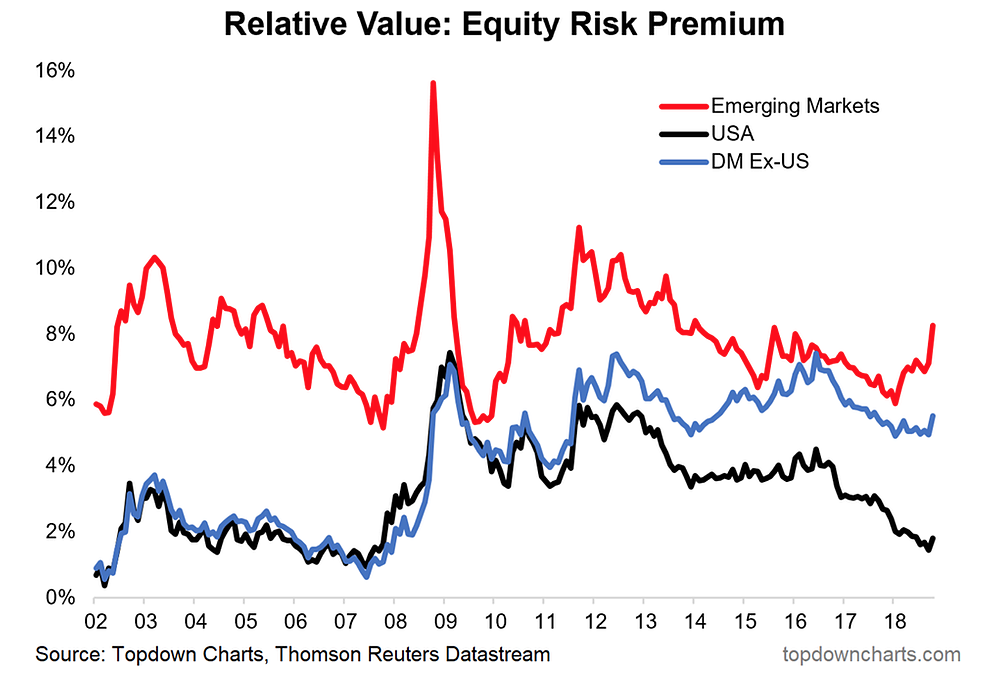

The valuation case for emerging (and developed) market equities relative to the US is still intact.

Markets

- By this measure 2018 has been an horribly bad year for investors. (bloomberg.com)

- How to think about spikes in the $VIX. (valueplays.net)

Strategy

- Don't let narrative distract you from the things that really drive stock prices. (albertbridgecapital.com)

- Patience and preparation are important for baseball players and traders, to boot. (allstarcharts.com)

Crypto

Amazon

- Amazon ($AMZN) throws down the free-shipping gauntlet this holiday season. (washingtonpost.com)

- Amazon ($AMZN) liked the HQ2 idea so much it is thinking of doing it twice over. (nytimes.com)

Finance

Funds

- Fulcrum-fees are the latest attempt to goose interest in active management. (wsj.com)

- A look at correlations among various factor ETFs. (capitalspectator.com)

Housing

- The Las Vegas real estate market seems to be cooling off. (calculatedriskblog.com)

- The CoreLogic September Home Price report shows an Increase of 5.6% year-over-year. (calculatedriskblog.com)

- Lumber prices are down 20% year-over-year. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Research links: decaying signal strength. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: sold rather than bought. (abnormalreturns.com)

- You are never done being you. (abnormalreturns.com)