Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"Buying put options for your portfolio is an expensive strategy; selling calls is a risky one. Neither is likely to improve your returns over the long run."

(Barry Ritholtz)

Chart of the Day

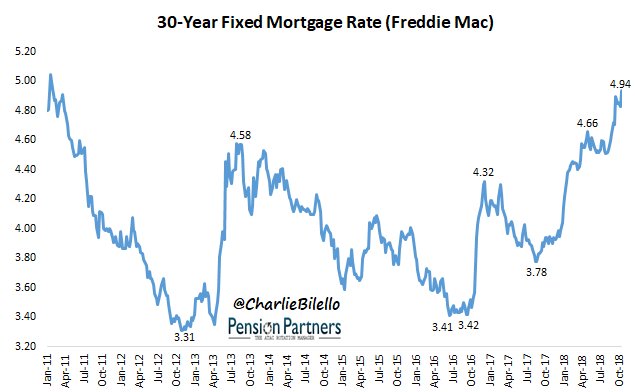

30-year residential mortgage rates at their highest level since February 2011. (via @charliebilello)

Strategy

- John Rekenthaler, "Avoid analyzing stock-market movements. Equities cannot be interviewed. They cannot explain why they behaved as they did." (morningstar.com)

- The existence of bubbles does not negate the principles behind holding a well-diversified portfolio. (theirrelevantinvestor.com)

- Don't sweat, too much, your 401(k) asset allocation. (awealthofcommonsense.com)

Apple

- Apple ($AAPL) may soon be your next-door neighbor. (ft.com)

- Amazon ($AMZN) will be an authorized Apple ($AAPL) product retailer. (theverge.com)

Quants

- Investors in quant funds, like AQR, are being tested, big-time. (bloomberg.com)

- Who knew? D. E. Shaw has a long-short equity portfolio managed by actual human beings. (wsj.com)

Books

- The ten best books of 2018 per Amazon editors. (businessinsider.com)

- Yet another anecdote about the dysfunctional state of modern book publishing. (m.signalvnoise.com)

- OK, mini-books are kinda cool. (qz.com)

Inflation

- TIPS-implied inflation is pulling back. (capitalspectator.com)

- If you want a straight-up inflation hedge there is only one way to go. (morningstar.com)

Earlier on Abnormal Returns

- Podcast links: rehabilitating a rogue trader. (abnormalreturns.com)

- What you missed in our Thursday linkfest. (abnormalreturns.com)

- Startup links: aging American companies. (abnormalreturns.com)

- You are never done being you. (abnormalreturns.com)