Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"Maximization always sounds like the answer. It keeps pulling us back into games that maybe we shouldn’t be playing."

(Tom Brakke)

Chart of the Day

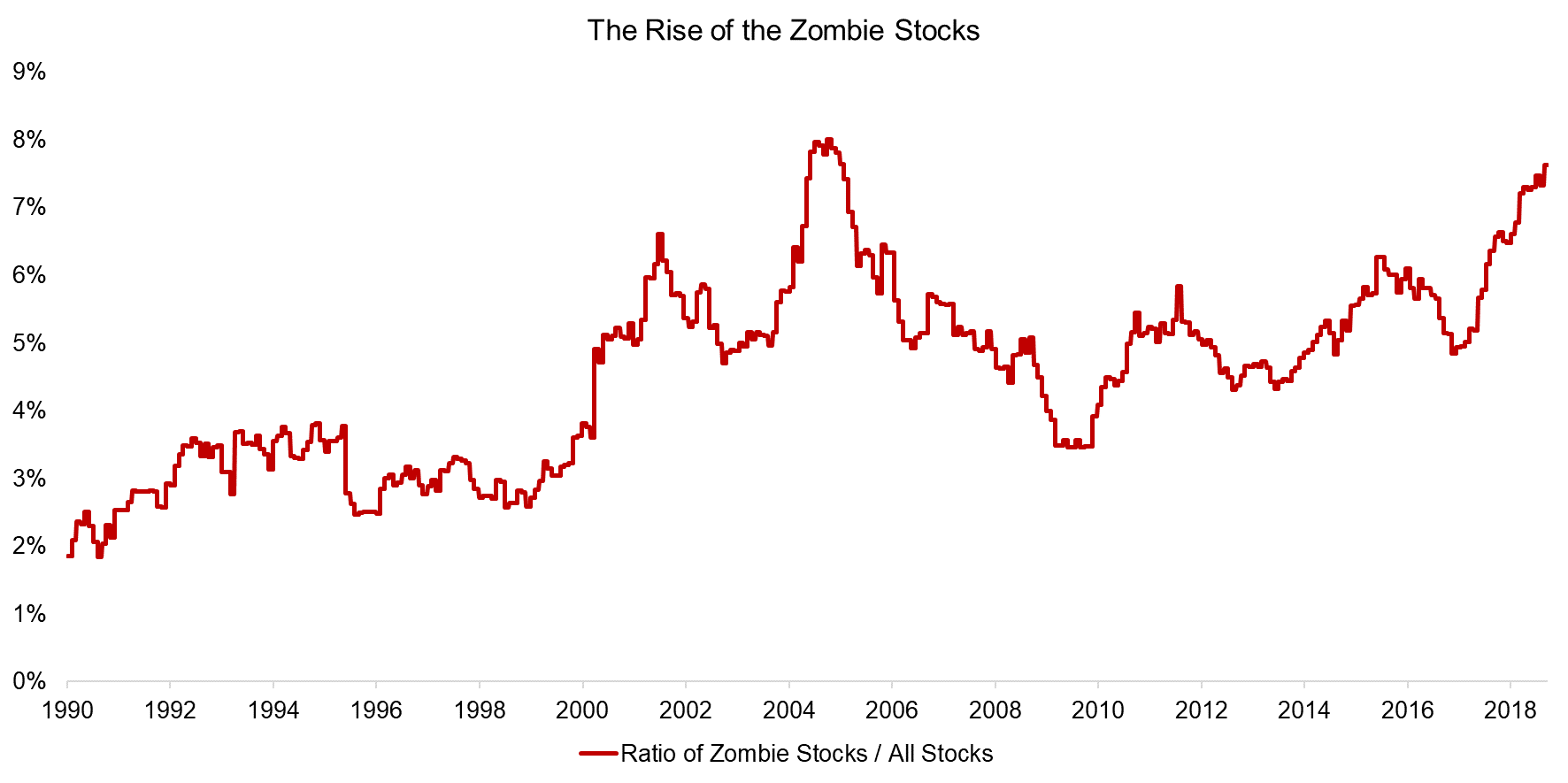

What are ‘zombie stocks’ and why are the ranks on the increase?

Markets

- Wall Street's obsession with earnings beats (and misses) is getting replaced. (wsj.com)

- US equities are the only major asset class with positive trailing one-year total returns. (capitalspectator.com)

Crypto

Companies

- The only way forward for GE ($GE) is to shrink. (ft.com)

- As bad as things are for cable, it's even worse for satellite TV providers. (wsj.com)

Fund management

- Jeffrey Ptak, "Active managers can be skilled in aggregate yet still fail to deliver value. In some respects, the best way to beat the index is to act like the index." (morningstar.com)

- As management fees get squeezed, so does compensation for employees. (wsj.com)

- Vanguard isn't going zero-fee for its index funds but is making its cheapest share class available to more investors. (citywireusa.com)

ETFs

- Why ETF iNAV premiums and discounts need to be taken with a grain of salt. (etf.com)

- A Q&A with the co-founders of Distillate Capital, manager of the newly launched Distillate U.S. Fundamental Stability and Value ETF ($DSTL). (etfdb.com)

Economy

- Homebuilder confidence fell sharply in November. (calculatedriskblog.com)

- The Millennial generation is catching back up on the economic front. (intrinsicinvesting.com)

Earlier on Abnormal Returns

- Adviser links: true fiduciaries. (abnormalreturns.com)

- At the intersection of art and money. (abnormalreturns.com)

- Envy, jealousy and the messy middle. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- Top clicks last week on the site. (abnormalreturns.com)