Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"Instead of trying to pinpoint the root cause of of volatility or downturns, we’d be better served looking in the mirror every once in a while. There are too many variables beyond our control for us to ascertain the true causation of market events."

(Phil Huber)

Chart of the Day

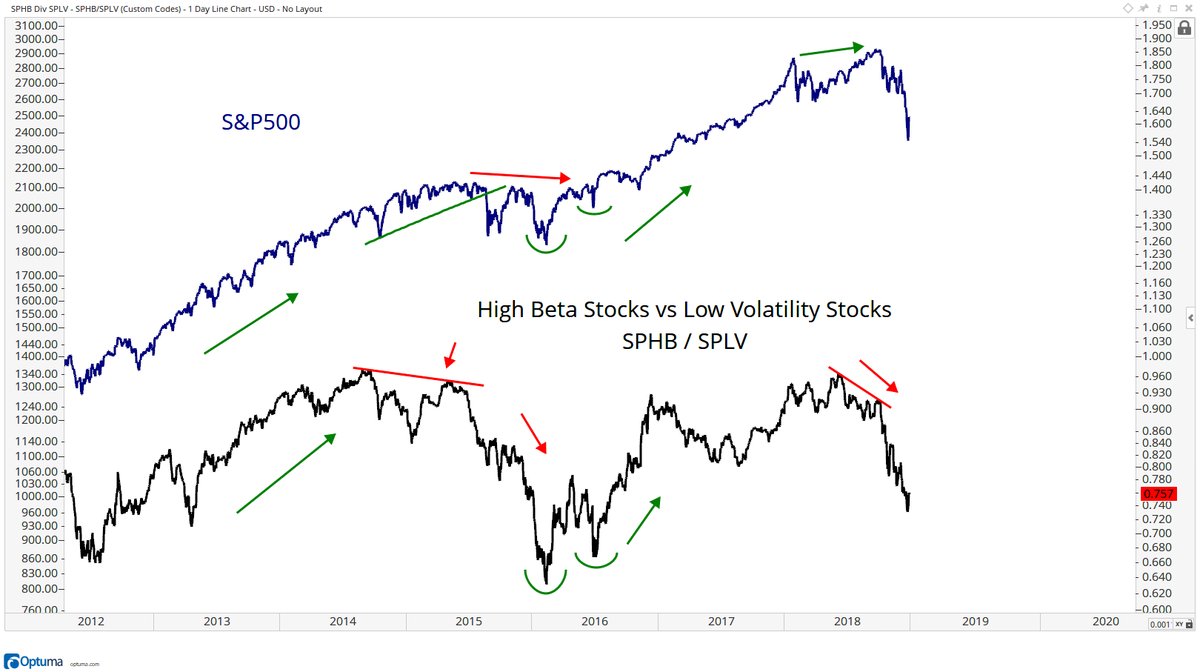

Since the market peaked in September low vol has crushed high beta. (via @allstarcharts)

Strategy

- A look back at 14 "forgotten" bear markets. (awealthofcommonsense.com)

- Sometimes stuff just stops working in the markets. (quantifiableedges.com)

- The beginning of the year is a great time to think (really) long term. (dashofinsight.com)

Self-promotion

- Sign up for our daily e-mail newsletter to stay up-to-date with all of our posts. (abnormalreturns.com)

- Check out our financial history-focused Market Moment every day in your Alexa flash briefing. (amazon.com)

Companies

- A big profile of Bob Iger and Disney ($DIS). (barrons.com)

- A look at the software sector heading into 2019. (medium.com)

Retail

- More companies are going cash-free. (wsj.com)

- Retail delivery drones are being tested. Dogs are not happy about it... (wsj.com)

Finance

Funds

Economy

- The data supporting a pause in Fed rate hikes. (pensionpartners.com)

- The 3 month-10 year spread is sitting at 0.35%. (econbrowser.com)

- A succinct summary of the week's economic events. (ritholtz.com)

- The economic schedule for the coming week. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Top clicks this week on the site. (abnormalreturns.com)

- What you missed in our Saturday linkfest. (abnormalreturns.com)

- Longform links: all-consuming parenting. (abnormalreturns.com)

- Dabbling in the markets is not the same thing as having a well-thought out investing plan. (abnormalreturns.com)