Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at Lego sets as an alternative asset class.

Chart of the Day

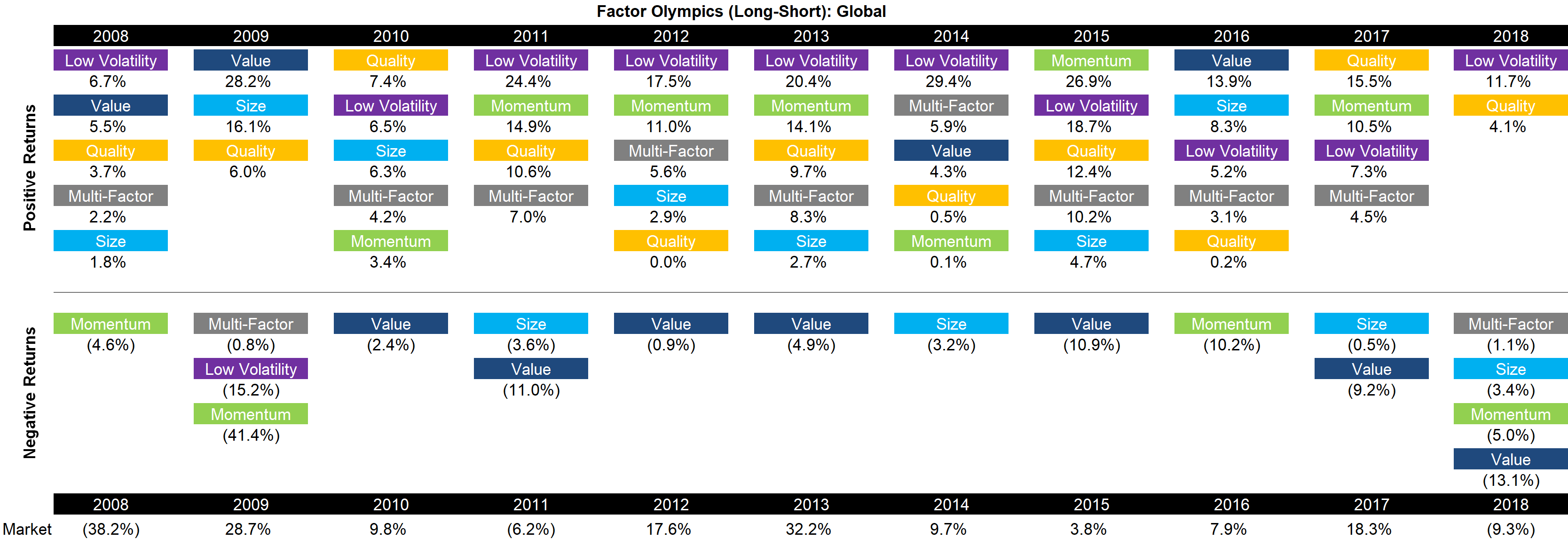

How various long-short factors performed on a global basis in 2018.

Retirement finance

- Monte Carlo simulations are powerful but often misused and misunderstood. (theretirementcafe.com)

- Research in retirement finance is a unique field. (rivershedge.blogspot.com)

Research

- The year 2018 has been a difficult one for the broad alternative risk premia (ARP) market. (researchaffiliates.com)

- Taxable investors would do well to focus on strategies that focus on after-tax returns. (alphaarchitect.com)

- What are the implications of PAPM or the Popularity Asset Pricing Model? (morningstar.com)

- Pricing Armageddon is harder than it looks. (alphaarchitect.com)

- Value mutual funds are not all the value-y. (nber.org)