Want to stay up-to-date with all of our posts? Sign up for our daily e-mail newsletter and get all the good stuff when it comes out.

Quote of the Day

"All in all, Amazon’s ascendancy is a reminder not of how new this era is but how old the dominance by big companies is. In some ways, these are the good old days: The top stocks account for less of the total market, and the giants don’t appear to be much easier—or harder—to topple than they used to be."

(Jason Zweig)

Chart of the Day

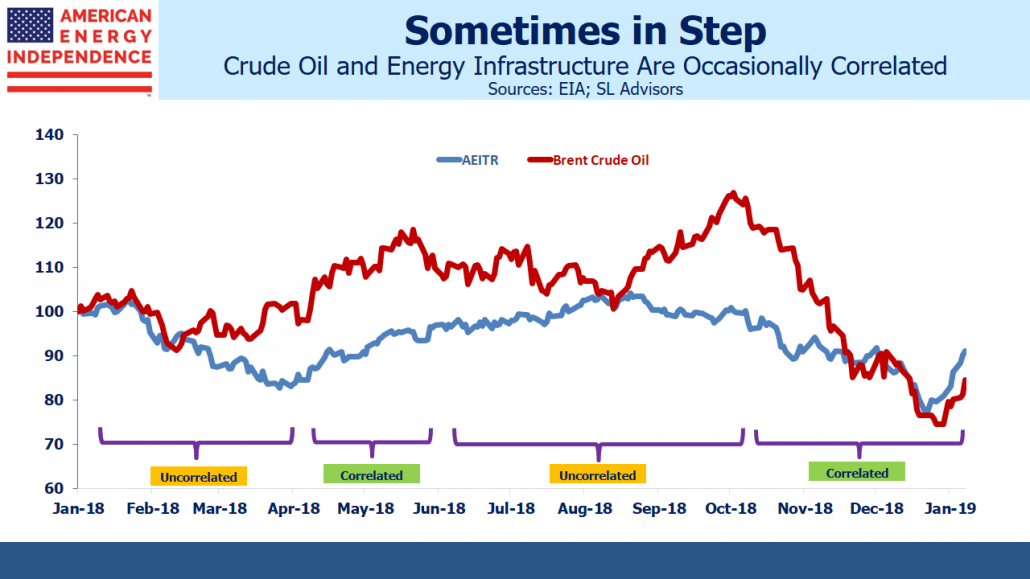

Sometimes energy infrastructure is correlated with oil, other times it isn’t.

Markets

- Is the correction over? A good summary of the historical precedents. (fat-pitch.blogspot.com)

- January option expiration week has historically been weak. (quantifiableedges.com)

Strategy

- Charlie Bilello, "It is one of the great paradoxes in markets that both extreme oversold and extreme overbought conditions tend to be followed by above-average returns. How is this possible?" (pensionpartners.com)

- Adam M. Grossman, "The stock market is not a tightly controlled lab experiment in which one can draw conclusions from the data. Far from it. Yes, there’s a lot of data, but much of it is contradictory and incomplete, so it shouldn’t be viewed as conclusive." (humbledollar.com)

Companies

Funds

- Why ETF providers keep coming up with narrow niche funds. (nytimes.com)

- Unicorn sighting: a new hedge fund of funds is launching. (institutionalinvestor.com)

Global

- "Employment has soared in Japan since 2012 even though the working-age population is plunging." (wsj.com)

- The world's largest economies in 2030. (visualcapitalist.com)

Economy

- Restaurant prices are on surging. (bloomberg.com)

- A succinct summary of the week's economic events. (ritholtz.com)

- The economic schedule for the coming week. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Top clicks last week on the site. (abnormalreturns.com)

- What you missed in our Saturday linkfest. (abnormalreturns.com)

- Longform links: not enough humility. (abnormalreturns.com)