Wednesday is all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at building a diversified ‘life portfolio’ in retirement.

Quote of the Day

"Writing a book and saving for retirement have one thing in common: They both require maintaining a sustainable average speed."

(Ross Menke)

Chart of the Day

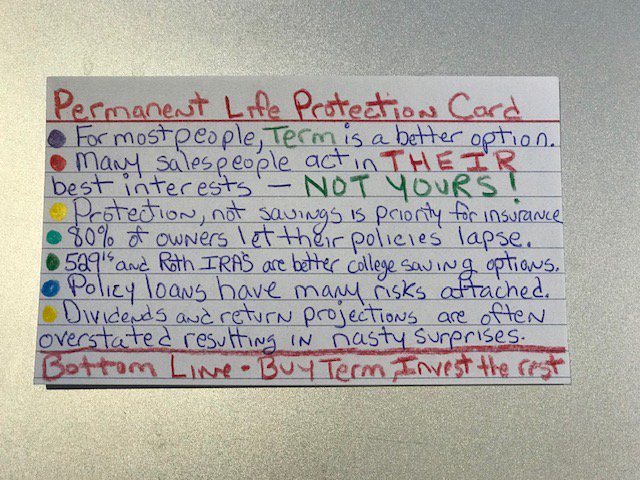

For most people buying term life insurance and investing the rest make sense. (via @ATeachMoment)

Retirement

- How RMDs can help guide your withdrawal strategies in retirement. (morningstar.com)

- How to free up some mental space to live your life and in retirement. (moneymaven.io)

- Don't miss these windows to sign up for Medicare. (retirementfieldguide.com)

- When splitting an estate equally just doesn't feel right. (financialsamurai.com)

Tax-deferred savings

- Sometimes you just have to make the best of a bad 401(k) plan. (morningstar.com)

- Hedging your tax bets: why you should try and max out non-taxable accounts first. (humbledollar.com)

Personal finance

- It's the big decisions you make in life that will affect your finances. (awealthofcommonsense.com)

- Why keeping our financial resolutions is so difficult. (independenceadvisors.com)

- Your savings rate is one thing you can definitely control. (theirrelevantinvestor.com)

- Why it's hard for couples to talk about money (and debt). (buzzfeednews.com)

- On the parallels between timeshares and college educations. (bonefidewealth.com)

- Why you need to approach annuities with a healthy dose of skepticism. (wsj.com)