Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the rise of multi-factor ETFs in the US.

Chart of the Day

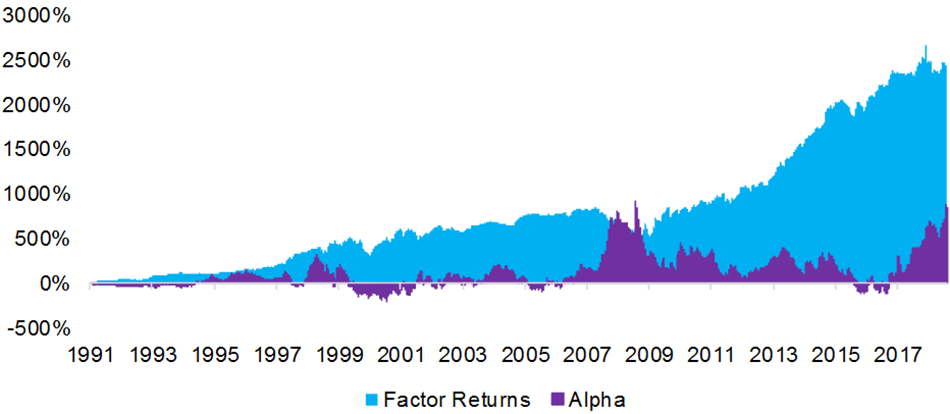

After factoring in factors, Warren Buffett’s Berkshire Hathaway ($BRK.A) has generated strong alpha of late. (via @FactorResearch)

Factors

- The cash-conversion-cycle seems to be an effective factor. (alphaarchitect.com)

- A census of the growing 'Factor Zoo.' (papers.ssrn.com)

- A look at "Factor Momentum Everywhere." (mrzepczynski.blogspot.com)

Private equity

- Is the 'illiquidity premium' really a thing? (allaboutalpha.com)

- An analysis of the recent cohort of companies taken private by private equity. (files.pitchbook.com)

Research

- Trend-following strategies tend to have convex returns. The question is how convex are they under different circumstances. (blog.thinknewfound.com)

- The 'overnight returns puzzle' is not really a puzzle. (albertbridgecapital.com)

- Aggregate investor self-confidence is related to trading activity and risk appetite. (alphaarchitect.com)

- A round-up of some recent research white papers on portfolio management. (capitalspectator.com)