Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at whether taxable investors should shun dividends.

Quote of the Day

"Free cash flow is the only fundamental metric that empirically tracks depreciation-related expenses. Unsurprisingly, when tested out as a factor, it outperforms other fundamental metrics."

(Patrick O'Shaughnessy)

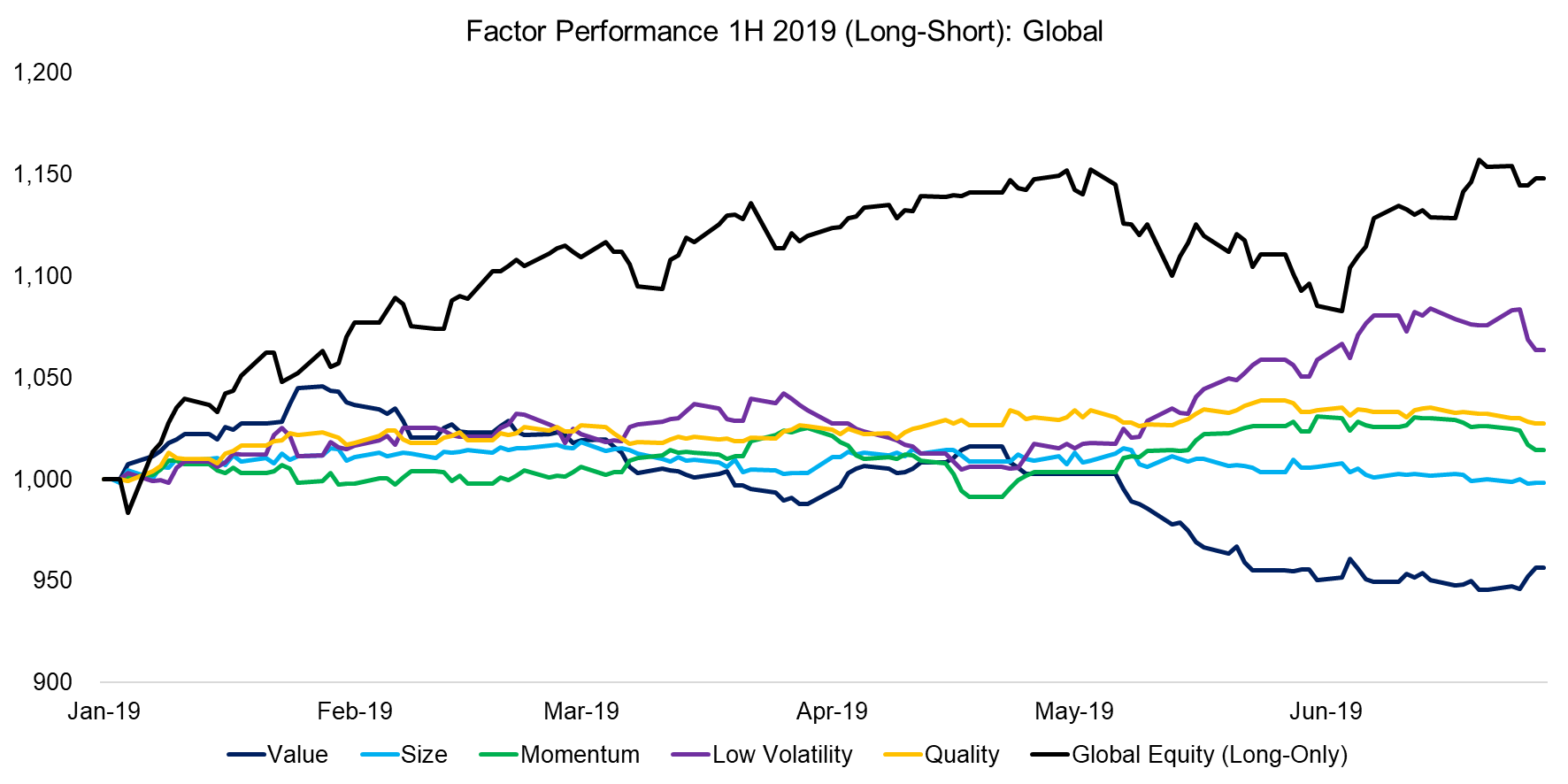

Chart of the Day

Checking in on the Factor Olympics for the first half of 2019.

Bonds

- Can valuation signals be used to time the bond market? (blog.thinknewfound.com)

- Factor-based bond funds are still in their infancy (institutionalinvestor.com)

- How the market for leveraged loan and high yield bond funds have changed in the past decade. (federalreserve.gov)

Trend following

- Trend-following strategies have worked historically but are likely too difficult for investors to hand on to. (alphaarchitect.com)

- The great benefit of trend following strategies is convex returns. (mrzepczynski.blogspot.com)

Modeling

- Why multiple models are better than one: the case for ensemble models. (springvalleyam.com)

- Here is the upside from using machine learning models in asset pricing. (alexchinco.com)

Factors

- Is company age a factor in and of itself? (papers.ssrn.com)

- B/P is not a great way to measure value. What's a better alternative? (alphaarchitect.com)

Research

- "The Earnings Mirage: Why Corporate Profits are Overstated and What It Means for Investors" by Jesse Livermore and the OSAM team. (osam.com)

- Why are we still talking about the CAPM? (institutionalinvestor.com)

- Four myths about stock buybacks debunked. (alphaarchitect.com)

- It's not enough for there to be skilled fund managers. (alphaarchitect.com)

- Corporate bankruptcies have a notable effect on employee wages. (papers.ssrn.com)