E-MAIL ALERT: Did you know you can get our links in your inbox every day? Sign up today – your brain will thank you.

Quote of the Day

"Bad things happen when funds that are priced daily, and that offer daily liquidity to shareholders, hold securities that are neither priced frequently nor can be readily traded."

(John Rekenthaler)

Chart of the Day

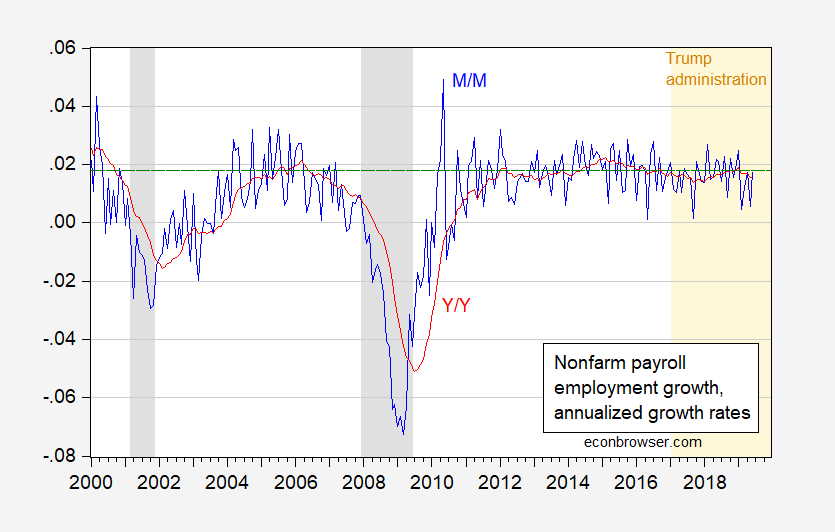

When you look at it this way the growth in US employment has slowed. (via @menzie_chinn)

Markets

- Chinese bond yields have not fallen much this year. (wsj.com)

- The yield curve is still pretty inverted. (ft.com)

- Russia and Central Europe have led global stock markets YTD. (capitalspectator.com)

- How tactical asset allocation strategies performed in June 2019. (allocatesmartly.com)

- Bull markets thrive on discontent. (scheplick.com)

Strategy

- Why do people still think some random snippet of information on a company gives them an edge? (thereformedbroker.com)

- It's not unusual for stocks and bonds to rally together like they have so far in 2019. (fortune.com)

- Don't confuse these asset classes for 'bonds.' (pragcap.com)

Companies

- Amazon ($AMZN) is putting additional pressure on its delivery network as it moves more work in-house and shifts toward one-day delivery. (businessinsider.com)

- Costco ($COST) breaks pretty much every rule in retail. (thehustle.co)

Finance

- Private equity firms are seeking to raise almost $1 trillion of new capital at the moment. (institutionalinvestor.com)

- Did you know the size of the leveraged loan market has doubled in the past seven years? (ft.com)

- Why fewer Chinese companies are choosing to go public on a US exchange. (barrons.com)

- If Masayoshi Son won't invest in Japanese startups, why should you? (bloomberg.com)

- Why investors can't get enough private investments. (economist.com)

Funds

- Matt Levine, "The sad fact of life for active managers is that they devote their careers to making markets more efficient, but if they succeed too well then they put themselves out of work." (ritholtz.com)

- Don't kid yourself. Factor timing isn't easy. (mrzepczynski.blogspot.com)

- Why you shouldn't be surprised by the tick up in ETF liquidations. (fa-mag.com)

Global

- London will not be LONDON, post-Brexit. (ft.com)

- Expensive urban areas are not unique to the US. (marketwatch.com)

- In 2018 births in Italy hit a record low. (reuters.com)

Economy

- The June NFP came in ahead of expectations including a 3.7% unemployment rate. (calculatedriskblog.com)

- On the myth of the tight US labor market. (finance.yahoo.com)

- A inverted yield curve plus high economic uncertainty have pushed the probability of a recession higher during 2019. (econbrowser.com)

- Why soybean farmers, in particular, are hurt by tariffs. (nytimes.com)

- Home price rises have decelerated across the country. (realestateconsulting.com)

Earlier on Abnormal Returns

- Podcast links: turning points. (abnormalreturns.com)

- Investing as a hobby (or not). My talk with David Schawel. (abnormalreturns.com)

- Startup links: living with disappointment. (abnormalreturns.com)

- What you missed in our Wednesday linkfest. (abnormalreturns.com)

- Personal finance links: retirement myths. (abnormalreturns.com)

- An alternative history of the ETF: what if Vanguard had been the first to launch? (abnormalreturns.com)

- On the loss of a helpful reading resource: Reading the Markets by Brenda Jubin. (abnormalreturns.com)

- Why that new car may not make you all that happy: talking transportation trade-offs with Ben Carlson. (abnormalreturns.com)