Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at why rebalancing is an active strategy.

Quote of the Day

"Investors have reaped the fruits of the past 30 years’ economic growth at the expense of everyday workers."

(John Rekenthaler)

Chart of the Day

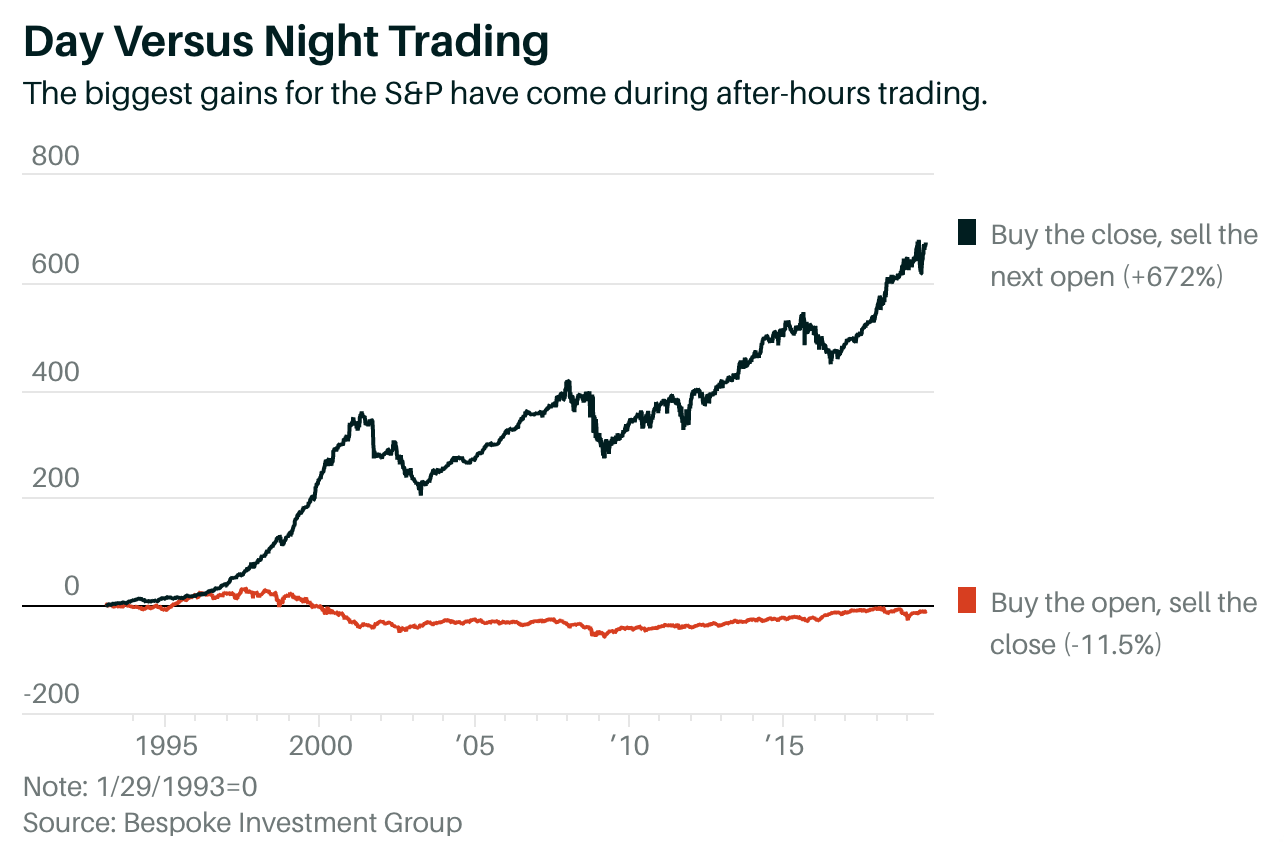

For the past couple decades all of the domestic stock market’s gains have come overnight.

Low vol

- Low vol has a lot of residual factor risk you need to take into account. (factorresearch.com)

- Can low vol strategies be improved? (alphaarchitect.com)

- On the upside of combining low vol with momentum. (blog.validea.com)

Alternatives

- Breaking down the risk profiles of endowment funds. (markovprocesses.com)

- Alternative mutual funds have been a big nothing burger for portfolios. (morningstar.com)

- What can investors do to hedge the risk in their private equity holdings? (man.com)

Corporate stuff

- When in doubt, invest in companies whose earnings calls are a laugh riot. (papers.ssrn.com)

- Data show female CEOs are much more likely to face an activist challenge. (wsj.com)

Quantifying innovation

- A big research piece showing that corporate innovation, i.e. patents, are mispriced by the market. (osam.com)

- Passive institutional ownership leads to more corporate innovation measured in terms of both patent quantity and quality. (papers.ssrn.com)

Behavioral blind spots

- Bond investors seem to ignore relevant financial information. (cfainstitute.org)

- Individual investors focus on stock prices even when fundamental data is available. (papers.ssrn.com)

- The return gap is higher with funds that disclose their holdings more frequently. (wsj.com)

Research

- How much of your TAA strategy's risk is due to asset vs. strategy? (allocatesmartly.com)

- Growth stocks have outperformed even though the growth factor has not. (factorresearch.com)

- Hedge fund managers perform better under pressure, i.e. outflows. (institutionalinvestor.com)

- Five facts about beliefs and portfolios culled from Vanguard investors. (papers.ssrn.com)

- For crowdsourcing to work, everyone needs an equal voice. (hbr.org)

- Why quant is a good fit for ESG. (institutionalinvestor.com)