Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at bias in manager selection.

Quote of the Day

On the value factor: “There’s no magic answer. If any of us had a good handle on this it would be part of the process itself.”

(Cliff Asness)

Chart of the Day

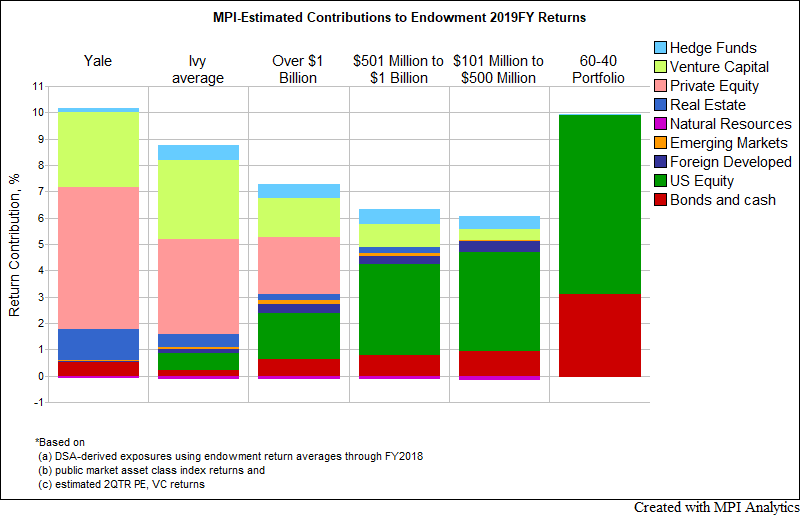

Another year, another chance for the 60/40 portfolio to best the Ivy league endowment funds.

Research

- What strategies perform best at crisis-proofing a portfolio? (alphaarchitect.com)

- A look at the returns from a leveraged Permanent Portfolio. (demonetizedblog.com)

- Five questions for Corey Hoffstein of Newfound Research. (blog.validea.com)

- Structured notes are a perfect example of individual investors biases being hijacked by Wall Street. (alphaarchitect.com)

- Evidence that private funds save the best strategies for themselves. (papers.ssrn.com)

- So-called 'boomerang CEOs' perform worse on average. (papers.ssrn.com)