Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the so-called ‘demise of value.’

Quote of the day

“So this is the stark choice that many organizations now face: Go with big data and machine learning, combined with other advanced quantitative technology, or leave finance to those who do.” – David H. Bailey

Chart of the day

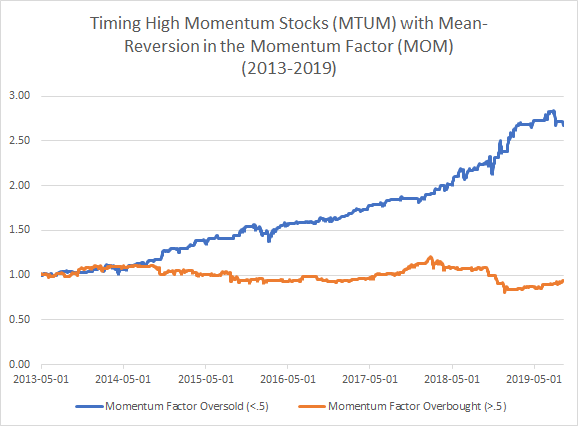

High momentum stocks seem to be mean-reverting in the short-term. (CSS Analytics)

Managed futures

- An examination of poor CTA performance over the past decade. (springvalleyam.com)

- Managed futures are not all about 'crisis alpha.' (mrzepczynski.blogspot.com)

- Why do managed futures ETFs and mutual funds underperform their private competitors? (factorresearch.com)

- AHL's co-founders now have very different beliefs about the efficacy of trend-following strategies. (ft.com)

Research

- The waiting is the hard part: even conservative allocations beat dollar-cost-averaging. (ofdollarsanddata.com)

- Why long-duration bonds are the best hedge against equity risk. (morningstar.com)

- Do alternative weighting schemes actually generate alpha? (mrzepczynski.blogspot.com)

- On the relationship between low vol and value. (factorresearch.com)

- Why high yield bond ETFs have a tendency to underperform their benchmarks. (mailchi.mp)

- How low-frequency measure misprice transaction costs. (papers.ssrn.com)

- Fund managers under 'weather risk' become more risk averse. (klementoninvesting.substack.com)

- A comparison of two different endowment spending methodologies. (alphaarchitect.com)