Wednesdays are all about personal finance here at Abnormal Returns. You can check out last week’s links including a look at why you need a plan for your time in retirement.

Quote of the day

“Sacrificing yourself financially for the sake of writing your children a blank check for education isn’t generous—it’s actually selfish.” – Tim Maurer

Chart of the day

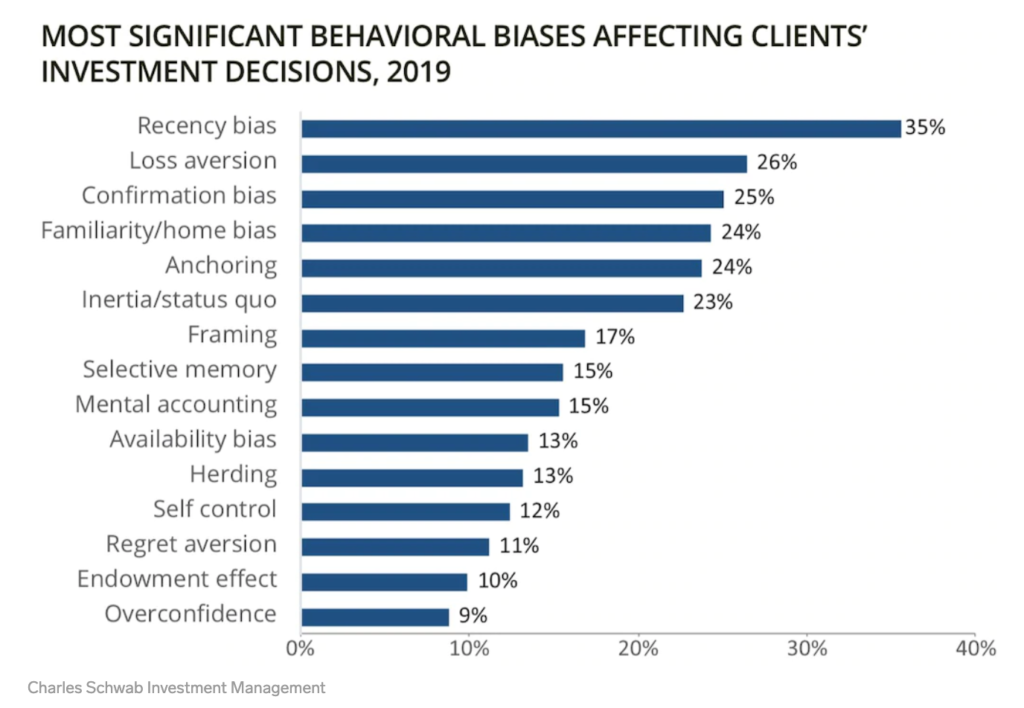

Investors are most prone to recency bias. (Business Insider)

Homes

- Paying off debt, especially mortgage debt, can provide peace of mind. (evidenceinvestor.com)

- Ben Carlson, "The old days of buy-and-hold with your home are probably over for the majority of people." (awealthofcommonsense.com)

Retirement

- No single "number" can capture your retirement readiness. (humbledollar.com)

- Not being able to live with dignity in retirement is the greatest financial risk. (ft.com)

Financial literacy

- Shockingly, financial literacy among Americans is actually getting worse over time. (msn.com)

- On knowing the difference between a financial product and financial service. (morningstar.com)

Personal finance

- On the importance of planning after you receive an inheritance. (nytimes.com)

- How to get on the same page with your spouse about money matters. (humbledollar.com)

- Some tax-smart charitable giving solutions pre- and post-RMD age. (vanguardblog.com)

- Why social comparisons are so tough for us. (libertywealth.ky)

- Why you need to think about no-brainer ideas. (financialducksinarow.com)

- How to plan for a career pivot. (frazerrice.com)