Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at why taking less capital at a lower valuation can work out for the best.

Quote of the day

“In a well run company, the CEO typically owns the terrain and the CFO owns the map.” – Ben Horowitz

Chart of the day

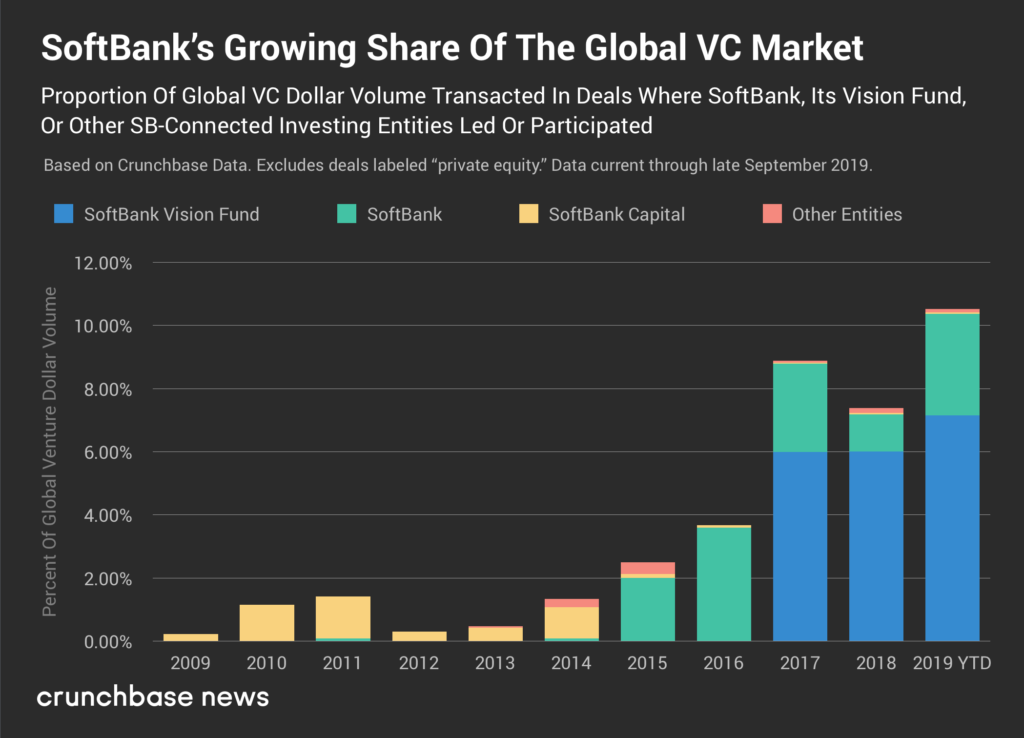

Softbank has done 10% of all VC dollars in 2019, year-to-date. (Crunchbase)

Fintech

- Online bank Dave has reached Unicorn status. (techcrunch.com)

- Atom Finance wants to be the Bloomberg for individual investors. (axios.com)

- Revolut's founders cashed in some shares in the most recent fundraising round. (ftalphaville.ft.com)

WeWork fallout

- Is the WeWork-type froth contained? (howardlindzon.com)

- The economic fundamentals of a business matter. (avc.com)

- There are no sure things in the startup world. (howardlindzon.com)

Venture capital

- Why VCs can't (or won't) fund moonshots. (venturebeat.com)

- How San Francisco came to dominate California VC dollars. (news.crunchbase.com)

Sectors

- How will Uber's entry into the on-demand worker space affect incumbents? (venturebeat.com)

- Will outlet shoppers flock to an online version? (fortune.com)

Startups

- The deal flow coming out accelerator programs can be overwhelming and impersonal. (haystack.vc)

- Every successful business experienced some luck along the way. (businessinsider.com)

- A framework for evaluating startups. (pointsandfigures.com)

- Evidence that firms aren't doing enough A/B testing. (papers.ssrn.com)

- Wow. Former company founders are disadvantaged when it comes to getting a job. (tristanbotelho.com)