Did you know you can stay up-to-date with all of our posts via our daily e-mail newsletter? Sign up today!

Quote of the Day

"This trend towards "green investing" has just begun. This will capture the public's attention in a way only rivaled by the DotCom bubble."

(Kevin Muir)

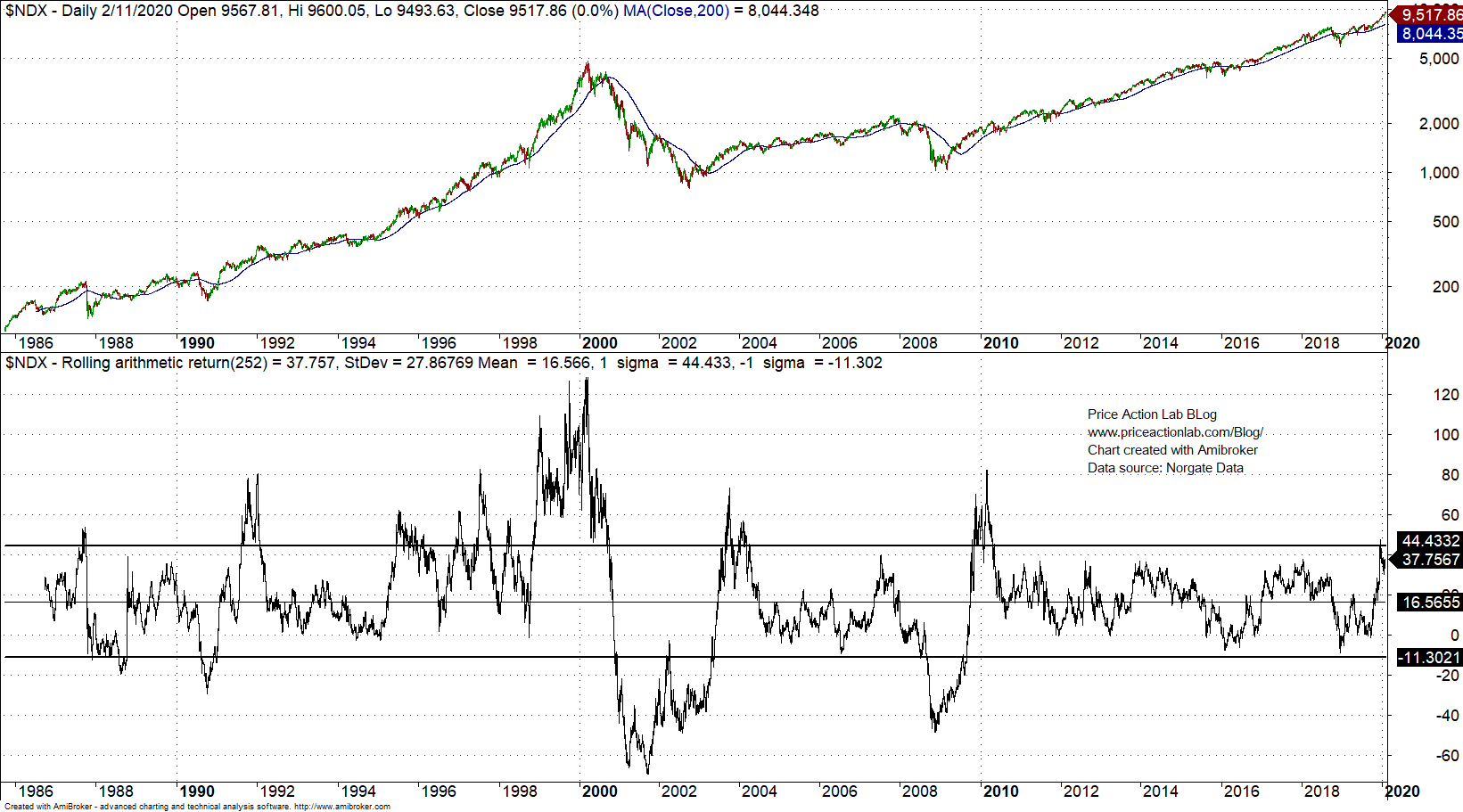

Chart of the Day

How unusual (or not) are current Nasdaq 100 year-over-year returns.

Strategy

- Every index is a bundle of different exposures and factors. (mrzepczynski.blogspot.com)

- Some reasons why factor investing is so challenging. (blog.validea.com)

Companies

- Facebook's ($FB) WhatsApp now has 2 billion worldwide users. (theverge.com)

- Apple ($AAPL) Pay is making inroads with users. (qz.com)

- A closer look at Uber's ($UBER) ride sharing unit economics is not encouraging. (ftalphaville.ft.com)

- Shopify ($SHOP) is crushing it. (bnnbloomberg.ca)

Regulation

- The Sprint/T-Mobile tie-up is going to mean higher prices down the road. (vox.com)

- The FTC has a fine line to walk when it comes to looking at Big Tech acquisitions. (stratechery.com)

Finance

- Why we need better disclosure of intangible assets. (visualcapitalist.com)

- Credit card delinquency rates for younger Americans are trending higher. (wsj.com)

- These were the highest earning hedge fund managers of 2019. (finance.yahoo.com)

ETFs

- The iShares ESG MSCI EM Leaders ETF ($LDEM) has already amassed ~$600milllion in AUM. (bloomberg.com)

- Some reasons why investors have embraced fixed income ETFs. (etf.com)

Global

Economy

- A look at some measures that show labor market tightness. (disciplinedinvesting.blogspot.com)

- We have normalized downwards are expectations for growth. (blogs.cfainstitute.org)

- What the US economy spends less on energy as a percentage of GDP is near record lows. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Personal finance links: needs and wants. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: a rehash of exposures. (abnormalreturns.com)