Mondays are all about financial adviser-related links here at Abnormal Returns. You can check out last week’s links including a look at how effective digital leads have been for advisers.

Quote of the Day

"The investment approach is far less important to the financial success of your clients than everything else. Your allocation of time and energy should reflect that."

(JD Gardner)

Chart of the Day

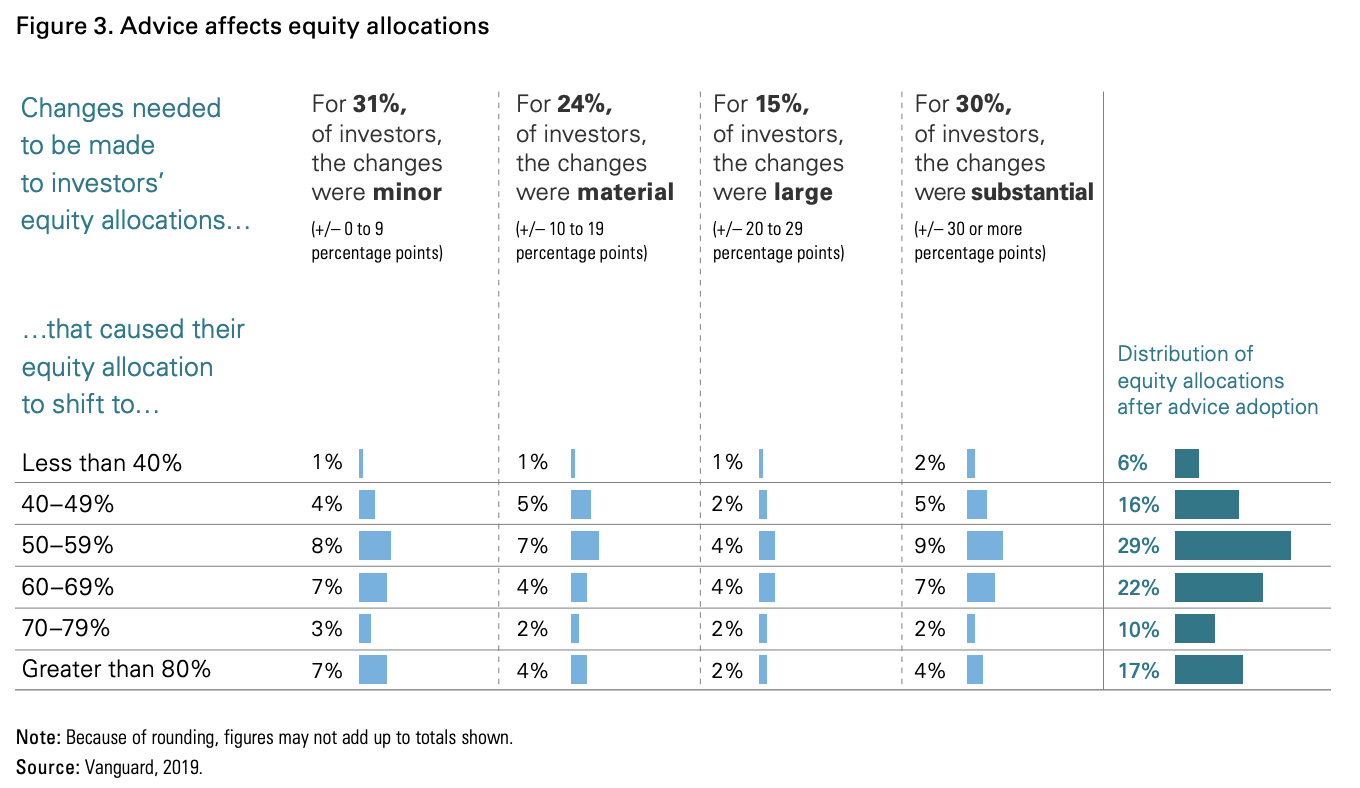

A new Vanguard research piece on how advice, both automated and personal, can help investors create more diversified portfolios.

The biz

- On the controversy about Fidelity's custody fees blew up on Twitter. (riabiz.com)

- Flourish continues to make inroads with RIAs. (riabiz.com)

- A profile of Josh Brown, CEO of Ritholtz Wealth Management. (marketwatch.com)

401(k)s

- Good news, bad news on the 401(k) front: greater enrollment and higher savings rates, but low balances for Boomers. (cnbc.com)

- Federal employees would see reductions in their retirement benefits under the White House’s proposed budget... (investmentnews.com)

IRAs

- Jeff Ptak and Christine Benz talks with Jeffrey Levine about how new legislation affects withdrawals, charitable giving, 401(k) plans, and more. (morningstar.com)

- For whom the SECURE Act rules on stretch IRAs matter, and for whom they don't. (kitces.com)

- The case for IRA contributions after age 72 is pretty limited. (morningstar.com)

Regulation

- In the wake of Reg BI, more states are going to introduce their own fiduciary standards. (investmentnews.com)

- Proposed SEC rules on advertising would ironically make certain forms of client communication more complicated. (investmentnews.com)

Advisers

- How to measure the client acquisition cost of a financial planning client. (kitces.com)

- How to deal with a client who won't follow your advice. (advicereinvented.com)

- Athletes are getting involved in PE and VC in more structured ways. (wsj.com)

- The why (and how) of integrating ESG options into client portfolios. (morningstar.com)