Among financial bloggers and FinTwit you will often hear examples about a friend or relative who is a ‘sure fire’ contrarian signal. That is, once they are interested in a stock/sector/trend it implies the end is near. Think, Thanksgiving dinner conversations about Bitcoin in 2017.

A consistently wrong-way trader or signal is in fact a valuable signal. This has important implications for investing. See this thread:

I’m with Corey on this one…if something is always terrible and you can lose on purpose, then you have a great strategy but just need to flip the signs.

If value is dead, then it should just be random noise and not a loser going forward. https://t.co/7a9cJlRm9a

— Andrew Miller (@millerak42) February 19, 2020

They were discussing the recent and long-standing poor performance of the value factor. Cliff Asness has a new piece up discussing the recent performance of value and how things might progress. Unfortunately for investors, only time will tell whether value, as currently constructed, is in fact a ‘dead’ factor.

Michael Mauboussin, author of The Success Equation: Untangling Skill and Luck in Business, Sports and Investing, has been discussing for some time about the role of skill and luck in investing. His work puts investing more towards the luck side of the skill-luck continuum. In a Q&A he said:

There is actually a very interesting test to determine if there is any skill in an activity, and that is to ask if you can lose on purpose. If you can lose on purpose, then there is some sort of skill. Investing is very interesting because it is difficult to build a portfolio that does a lot better than the benchmark. But it is also actually very hard, given the parameters, to build a portfolio that does a lot worse than the benchmark.

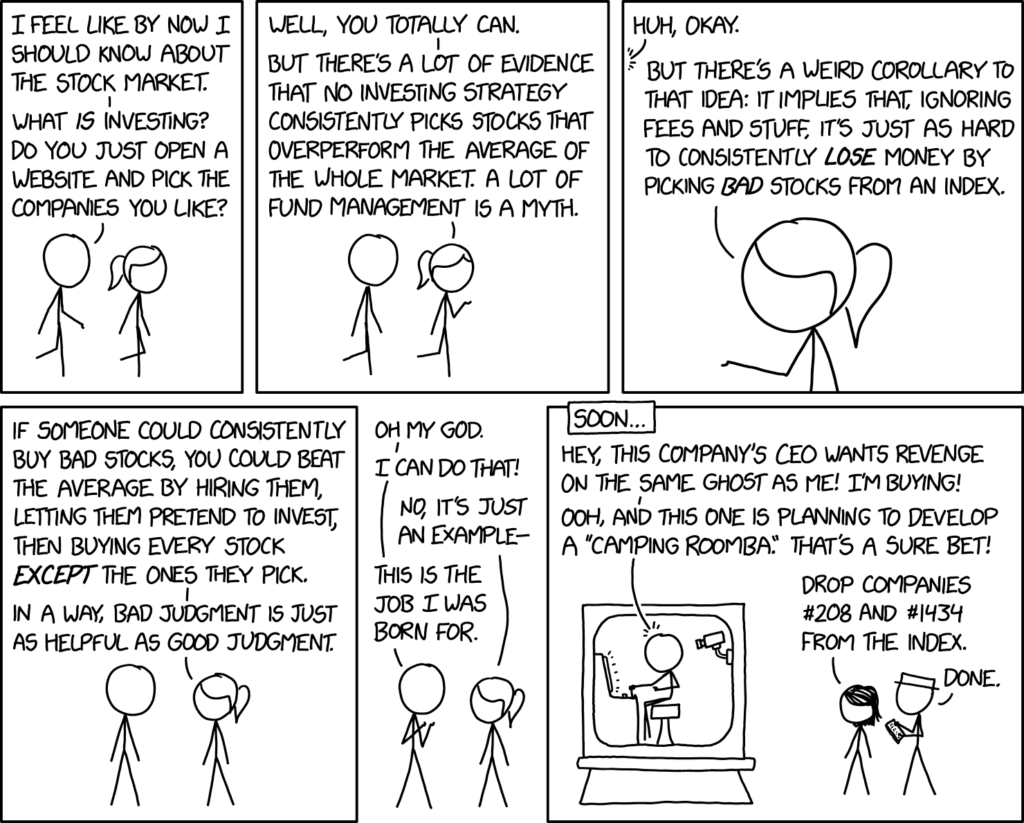

Finding a true, wrong-way trader would be of great find. In a a recent comic from XKCD you can see how this could play out:

Source: XKCD

There is a difference between random and wrong. The challenge is knowing the difference.