In stressful times like this we want to do something, anything, to help relieve our anxiety. Some of us run to Costco to load up on non-perishables. Others trade like crazy. The former probably won’t hurt, the latter probably will. In the best circumstances we end up doing something that is productive and financially beneficial.

Just refi’d our mortgage again. Banker said it was the lowest rate she’d ever locked (2.625) so expect rates to go lower again I suppose. Or I caught a bottom once in my life.

— James Osborne, CFP® (@BasonAsset) March 3, 2020

When you took out a mortgage on your house you also received the option to prepay that mortgage without penalty. What that means in practice is if mortgage rates fall (enough) you can refinance your current mortgage with a new mortgage at a lower rates. Thereby lowering your monthly payments. Pretty cool, huh.

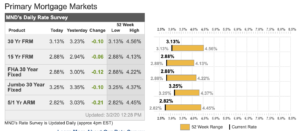

Source: Mortgage Daily News

Guess what? Mortgage rates have fallen to their lowest level in the last 12 months. Rates were falling even before coronavirus-induced anxiety kicked in. This means you now have an opportunity to push one of your ‘wealth levers.’ Ben Carlson writing at A Wealth of Common Sense in this post talks about the ‘four levers of wealth.’ One of which is how much you pay for housing. There is a relationship between where you live and how much you can make, but wherever you live there are a range of options on how much you pay for a space to live.

In the very short run you can’t change where you live, without moving, but you can change how much you pay on a mortgage. So if you haven’t checked out what is going on with mortgage rates, why not? Refinancing a mortgage is a paperwork hassle, no doubt. However, unlike trying to time and zigs and zags in stock market there is a guaranteed payoff.*

Nobody knows with certainty what is going to happen with mortgage rates in the short (or long) term. The beauty is that you have the right, but not the obligation, to exercise your refinancing option. The process, think paperwork, will take some time on your end, so it helps to get started sooner rather than later. You may be surprised how much you can lower your ongoing costs and avoid making other fear-induced mistakes.

*Peter Dunn suggests that if you do refinance you mortgage that you try to reduce (or maintain) the term of your current mortgage.