Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the non-normality of moves in the VIX.

Quote of the Day

"Over the long term, companies with negative cash flows have produced negative returns."

(Larry Swedroe)

Chart of the Day

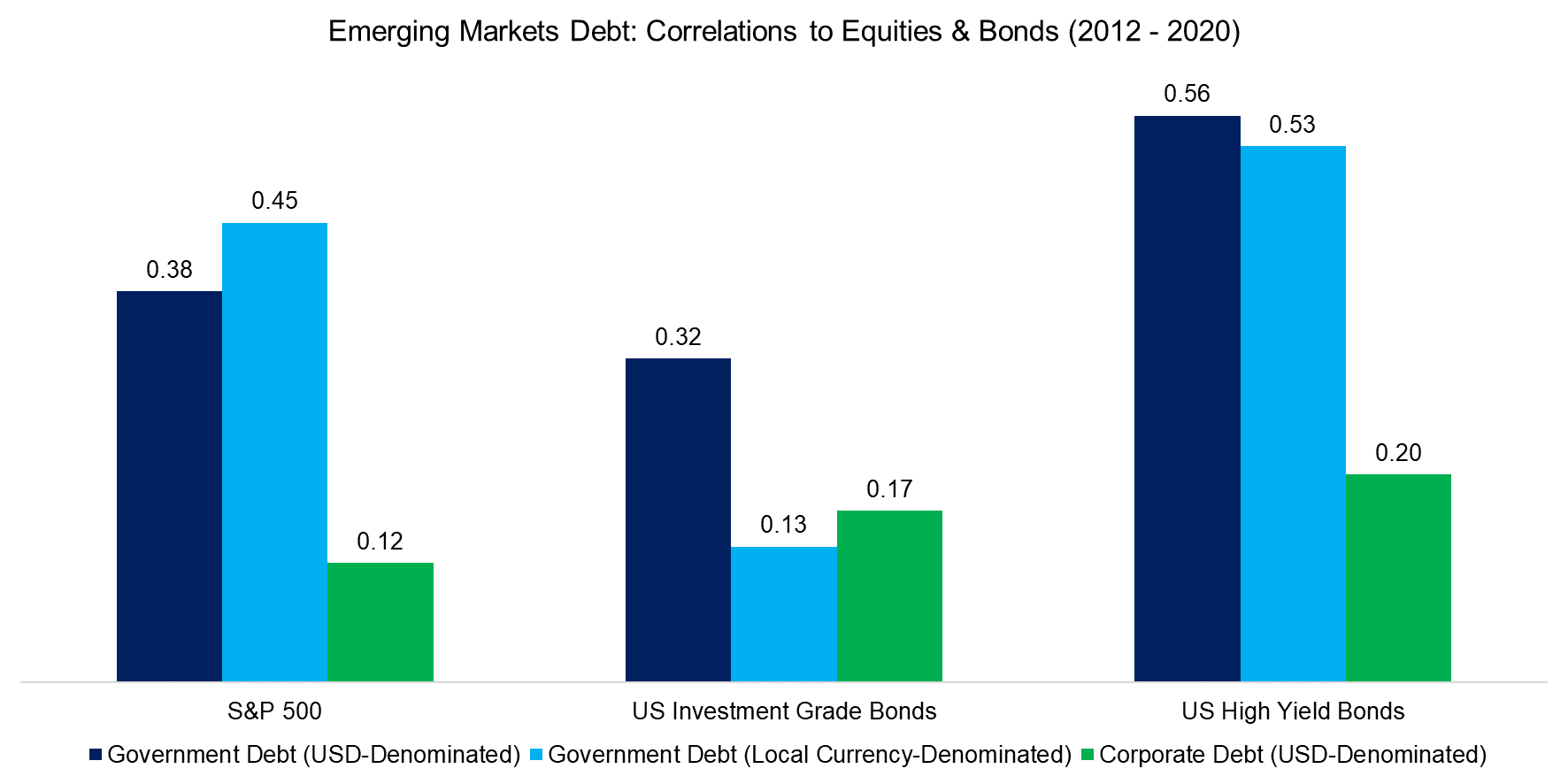

The correlation of emerging market debt are still relatively low.

Trend and momentum

- Comparing the performance of low vol/momentum portfolios vs. value/momentum combos. (alphaarchitect.com)

- How and why trend models diverge. (blog.thinknewfound.com)

- Momentum 101. (academicinsightsoninvesting.com)

Research

- Where did the myth of the panicky individual investor come from? (dpegan.com)

- Do insider trades provide any useful information to investors? (alphaarchitect.com)

- What type of fund managers do well when trading? (klementoninvesting.substack.com)

- For companies, hedge fund activism causes a short-term bump followed by a longer term lag in performance. (institutionalinvestor.com)