Did you know you can stay up-to-date with all of our posts via our daily e-mail newsletter? Sign up today!

Quote of the Day

"I don’t see any meaningful bottom for stocks until we get some wins against the virus."

(Josh Brown)

Chart of the Day

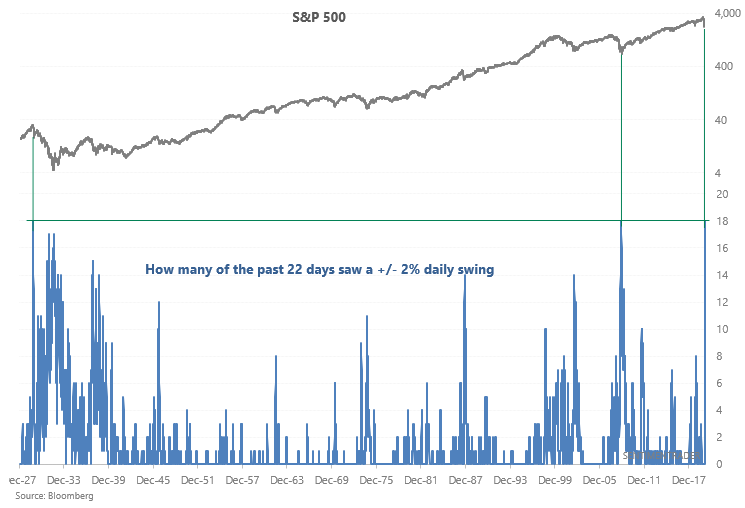

It’s not your imagination. We are in the midst of one of the three most volatile periods for the stock market in history. (via @sentimentrader)

Markets

- Wide moat companies have outperformed during this bear market. (morningstar.com)

- Small cap stocks have markedly underperformed large caps. (wsj.com)

- Private equity replication strategies are indicating a big drawdown. (institutionalinvestor.com)

Strategy

- 10% up days are not normal. (theirrelevantinvestor.com)

- Markets have had to incorporate a lot of information all at once. (blairbellecurve.com)

- Point, counterpoint on small cap value stocks. (blog.validea.com)

Crypto

Companies

- Why hasn't Warren Buffett done any deals yet? (ritholtz.com)

- Target ($TGT) saw a surge in food and household good sales while other areas slumped. (wsj.com)

- Boeing ($BA) got a special provision in the Senate's stimulus package. (washingtonpost.com)

Media

- Media usage is up, but ad rates have cratered. (vox.com)

- NBCUniversal has an Olympic-sized programming hole to fill. (variety.com)

- HBO has seen a 40% increase in streaming hours. (thestreamable.com)

Insider trading

- The opportunity for insider trading is increased in this volatile environment. (washingtonpost.com)

- Why members of Congress should not be able to engage in discretionary trading. (investmentnews.com)

Finance

- Companies are drawing down their credit lines whether they need them now or not. (ft.com)

- Why the mortgage market is in turmoil. (finance.yahoo.com)

- Apollo Global ($APO) is calling capital to take advantage of distressed opportunities. (msn.com)

- The stock buyback debate now seems quaint. (nytimes.com)

Fund management

- Blackrock ($BLK) is going to help the Fed manage their bond purchases. (wsj.com)

- Smaller asset managers are increasingly at-risk in this bear market. (institutionalinvestor.com)

Covid-19

- The current age highlights plenty of contradictions. (collaborativefund.com)

- How music festival assets could be repurposed in a time of need. (ftalphaville.ft.com)

- Why many construction projects are still going on. (slate.com)

Social distancing

- How to do social distancing right. (theatlantic.com)

- What social distancing means in practice. (alphaarchitect.com)

- Mapping how well US states are doing social distancing. (washingtonpost.com)

- National parks are closing to help prevent crowding. (nytimes.com)

Global

- Sweden is not taking steps that other European countries are doing. (ft.com)

- Spain is getting hammered by coronavirus. (marketwatch.com)

- Why Germany's coronavirus infection rate is lower than neighbors. (npr.org)

- Researchers think more in the UK may have already been exposed to Covid-19 than thought earlier. (ft.com)

- No country in the West has gone as far as China did in locking down infected patients. (wsj.com)

- The flower business in the Netherlands is under unique strain. (npr.org)

Economy

- There's more than one kind of systematic financial stress the Fed needs to deal with. (mrzepczynski.blogspot.com)

- Vehicle sales fell off a cliff in March. (calculatedriskblog.com)

Earlier on Abnormal Returns

- Personal finance links: the value of a plan. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: unnatural interest rates. (abnormalreturns.com)