Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at what we can learn about stock market performance around prior pandemics.

Quote of the Day

"Academic investment research implicitly assumes that the economic conditions that created those results will persist. There is strong reason to believe that will not be so."

(John Rekenthaler)

Chart of the Day

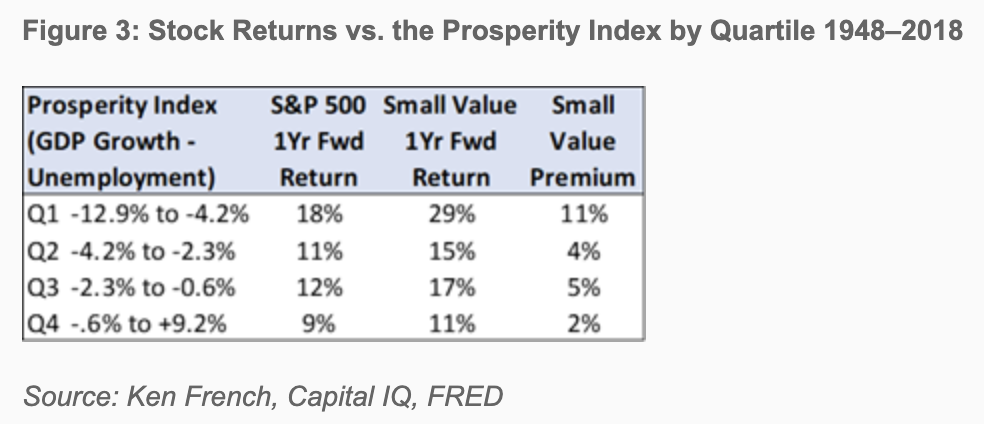

The small value premium has historically been highest during bad economic times. (via Verdad Capital)

Quant

- Winton Capital's returns demonstrate it is no longer a trend-following manager. (ft.com)

- Poor performance and shrinking AUM is putting quant jobs at-risk. (news.efinancialcareers.com)

Momentum

- Is time-series momentum really all that powerful? An examination. (alphaarchitect.com)

- How volatility scaling affects momentum returns. (alphaarchitect.com)

Research

- How various factors performed during Q1. (factorresearch.com)

- Do high yield bonds show any return premium over time? (falkenblog.blogspot.com)

- How did equity styles perform during the period around the Spanish Flu pandemic of 1918-1919? (alphaarchitect.com)

- Volatility, dispersion and correlation with all see a slow decay over time. (mrzepczynski.blogspot.com)

- The more 'experience' an investor has with a stock the shorter their holding period. (klementoninvesting.substack.com)