Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at whether we live in a single-factor world in reality.

Quote of the Day

"So while the Stock Act worked, it’s not airtight. A simple fix is to require members of Congress to preannounce stock trades."

(Aaron Brown)

Chart of the Day

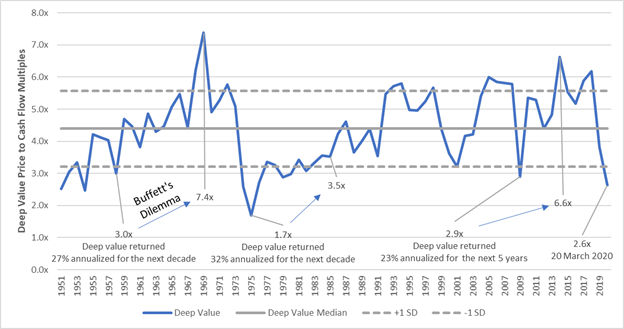

Deep value stocks look cheap relative to history. (via Verdad Capital)

Trend following

- Should you tranche your trend following strategy? (blog.thinknewfound.com)

- In defense of trend following. (alphaarchitect.com)

Performance

- A look at the dispersion in risk parity fund performance. (markovprocesses.com)

- A look at the performance of tail risk hedge funds. (factorresearch.com)

Value

- Value may be cheap, but when should you bet on its comeback? (falkenblog.blogspot.com)

- Bear market recoveries usually feature small cap value stocks. That hasn't happened yet. (institutionalinvestor.com)

Quant stuff

- The myth of 'Turnaround Tuesday' or why you shouldn't let hindsight bias affect your research. (priceactionlab.com)

- How you should deal with lags in economic data in a back test. (allocatesmartly.com)