Thursdays at Abnormal Returns are all about startup and venture capital links. You can check out last week’s links including a look at how to think about base rates during spikes (and drops) in business.

Quote of the Day

"Together with data, cloud, and automation — companies are going to be looking at a more resilient future, one that sits on top of a network. It is not as if they had a choice. COVID-19 has exposed one harsh truth: digital channels are more flexible and faster to adapt to change than physical channels."

(Om Malik)

Chart of the Day

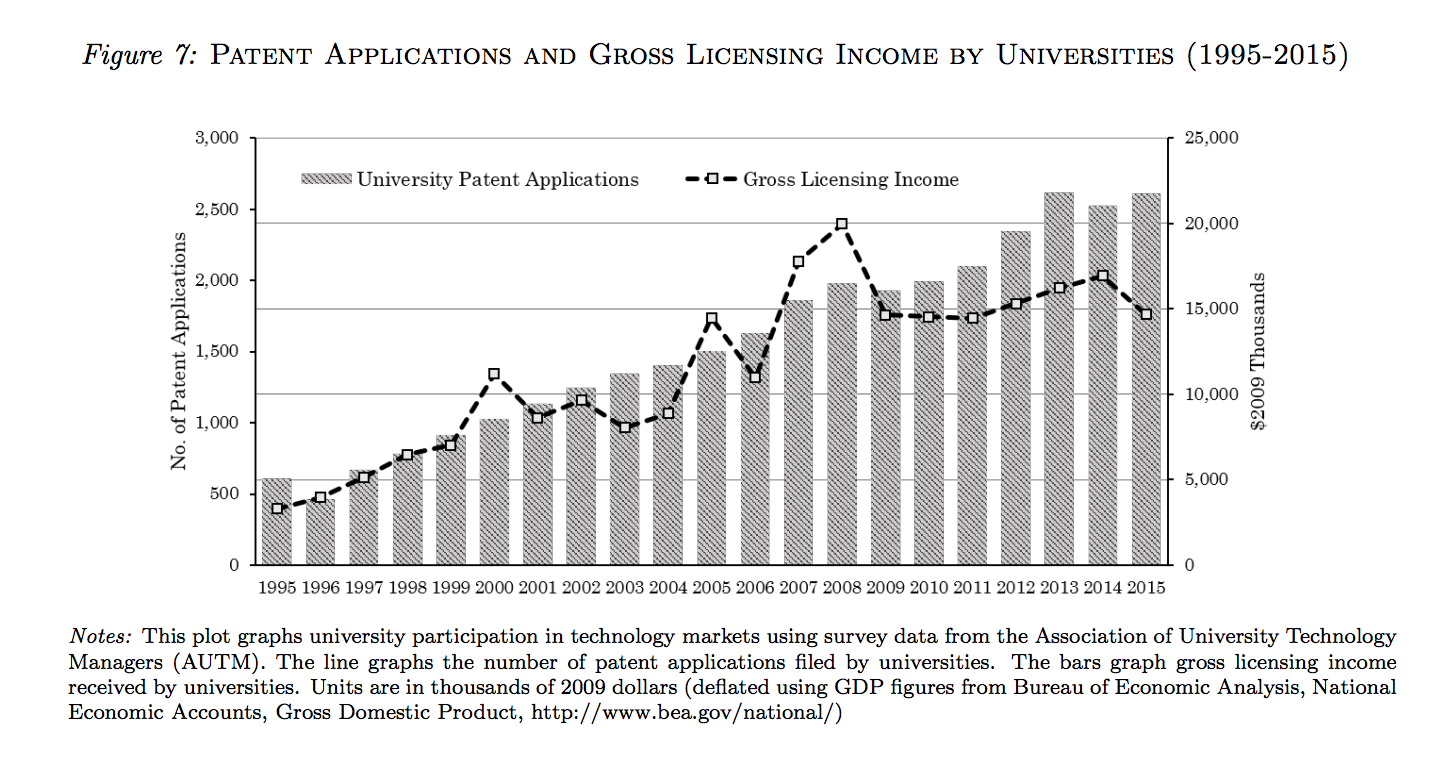

Have startups been fueling a brain drain from US universities?

Fintech

- Robinhood raised a Series E round to help fund overseas expansion. (fortune.com)

- Digital bank N26 just raised a Series D to become Europe's most valuable challenger bank. (cnbc.com)

- Since its launch in 2015, Revolut has been quick to plant flags in new markets. (ft.com)

Valuations

- How long before we see a reset in valuations? (ldeakman.com)

- Some early hints on how valuations are changing. (tomtunguz.com)

- Valuation cuts have come to Silicon Valley. (ft.com)

Seed

- What is the First Round Capital 'second round guarantee'? (firstround.com)

- Seed stage investors who invest in more deals have shown higher returns. (kauffmanfellows.org)

Companies

- How Figma "does for design and designers what GitHub did for code and developers." (a16z.com)

- Ya gotta love any company named Cockroach Labs. (news.crunchbase.com)