Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at the crummy performance of tactical allocation ETFs of late.

Quote of the Day

"Portfolios reveal our market views whether we admit it or not."

(Mark Rzepczynski)

Chart of the Day

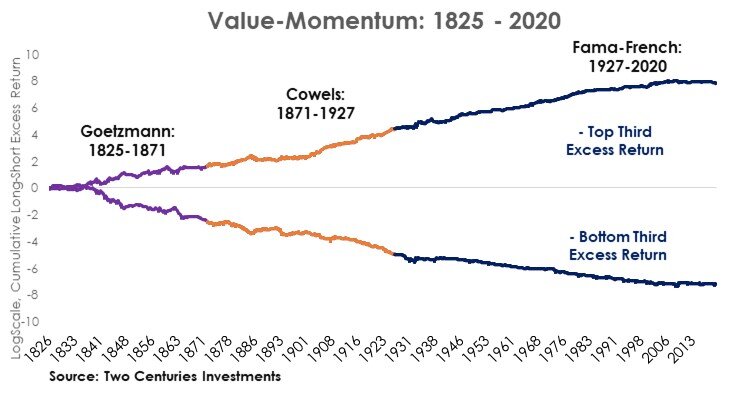

What does a really long time series say about the drawdown in value?

Tail risks

- What the Taleb-Asness fight teaches us about tail-risk hedging. (bnnbloomberg.ca)

- Investors don't need to put all their (diversification) eggs in the tail risk basket. (mailchi.mp)

Behavioral stuff

- A look at how media has reflected stock market sentiment historically. (investoramnesia.com)

- On the interaction between emotions and risk tolerance. (advisorperspectives.com)

Quant stuff

- Which is a more appropriate strategy benchmark: cap or equal-weighted? (cxoadvisory.com)

- Can machine learning techniques be used to build a better defensive equity strategy? (blog.thinknewfound.com)

- Some open data resources to track the economy and industries. (permanentequity.com)

Momentum

- Is equity market momentum losing its punch? The factor has been in decline for years. (marketwatch.com)

- When it comes to momentum signals, more periods of outperformance, the better. (klementoninvesting.substack.com)

Research

- Maybe 'semibetas' are priced, not betas. (privpapers.ssrn.com)

- If you want the benefit of CTA convexity it has to following a trend following strategy. (mrzepczynski.blogspot.com)

- A 'fallen angel' bond portfolio outperformed other high yield bonds for awhile, but stopped f few years ago. (morningstar.com)

- Larry Swedroe on 'the golden ratio' says about gold prices. (seekingalpha.com)