Are you already signed up for our daily e-mail newsletter? Great, but did you know that we just launched an adviser-focused e-mail on Fridays? Now you do. Sign up here!

Quote of the Day

"If I can be permitted one pretty uncontroversial prediction, it is that the narrative, NOT the reality of inflation or correlation matrices in the real world, will be the force that causes investors to change their behaviors and portfolios."

(Rusty Guinn)

Chart of the Day

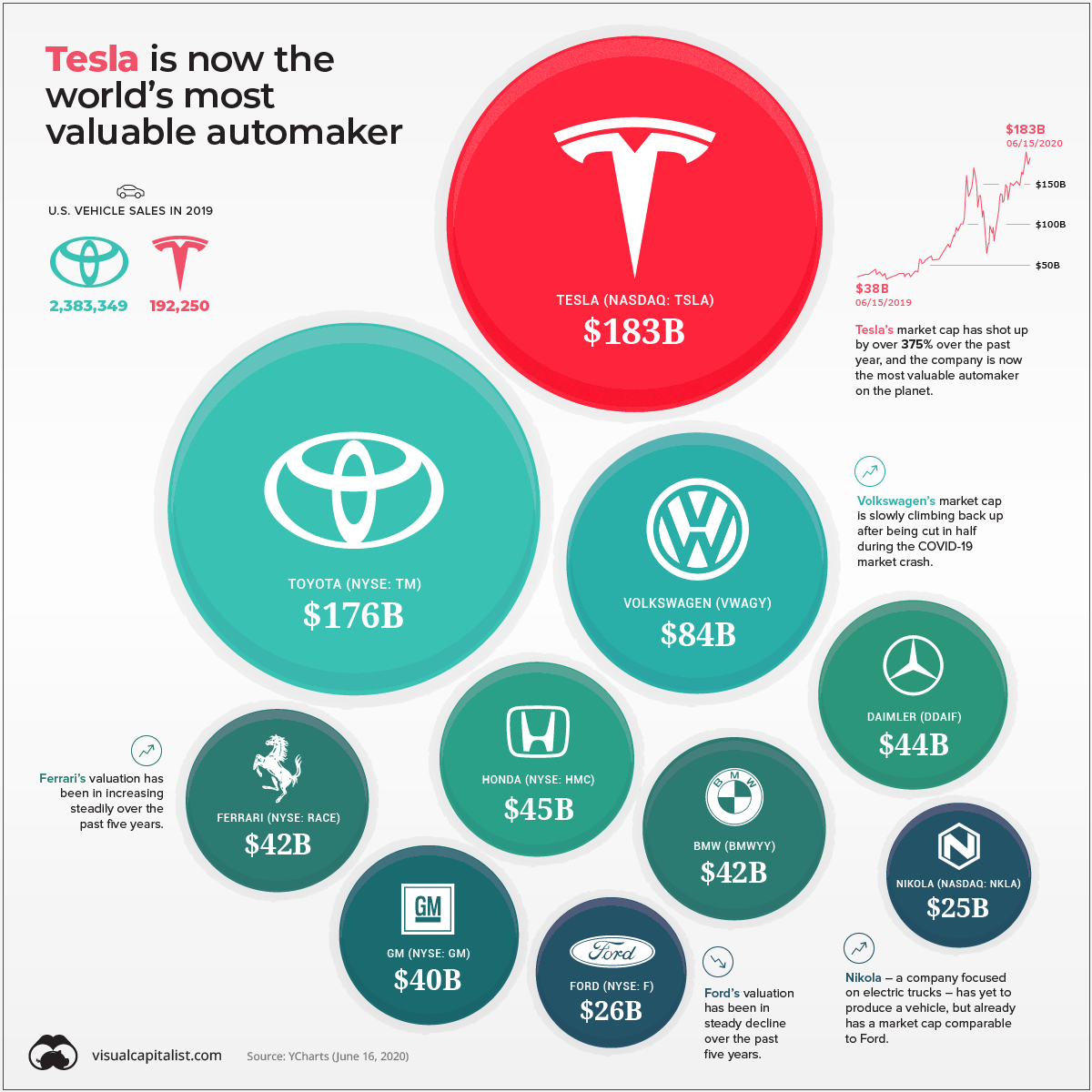

Tesla ($TSLA) is now the world’s largest automaker by market cap.

Markets

- Is there any way to reconcile the idea of efficient markets with what we are seeing these days? (ritholtz.com)

- Another wacky data point in pandemic markets. (ftalphaville.ft.com)

- Small investors don't make up much of their market but their actions can have ripple effects. (zeninvestor.org)

Strategy

- There are valid reasons to sell, but doing so in a panic isn't helpful. (awealthofcommonsense.com)

- These are the main differences between a quantitative and discretionary investment approach. (blog.validea.com)

- Successful investing involves a lot of waiting around. (safalniveshak.com)

Companies

- Big Tech is going to have to expand into adjacent markets to keep growing. (howardlindzon.com)

- Softbank is looking to offload share in the combined T-Mobile ($TMUS). (cnbc.com)

- Target ($TGT) is raising its minimum wage to $15 a hour earlier than expected. (businessinsider.com)

Finance

- Companies are scrambling to get their IPOs back on track. (nytimes.com)

- High frequency traders are planning to bypass fiber optic cables in favor of shortwave radio. (bloomberg.com)

- Americans are applying for mortgages like crazy post-lockdown. (housingwire.com)

- Proptech is only going to get bigger as investment continues to flow into the space. (news.crunchbase.com)

Global

- Deflation has returned to Japan. (wsj.com)

- South Korea demonstrates that even if you successfully reopen the economy things don't go back to normal. (ft.com)

Spending

- With many spending categories cut off in the pandemic, those still with jobs are spending more on their houses and things like boats. (wsj.com)

- The reshuffling of spending priorities by the wealthy is reverberating through the economy. (nytimes.com)

- The stuff wealthy Americans spent on have gone away in pandemic. (npr.org)

- The shift away from cash to other payment forms is accelerating in pandemic. (markets.businessinsider.com)

Economy

- Signs that the US economy is reviving. (capitalspectator.com)

- Is Fed action only making the problem of 'zombie companies' worse? (finance.yahoo.com)

- A reckoning for state pension plans is coming. (ft.com)

Earlier on Abnormal Returns

- Personal finance links: the road to wealth. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: multiples are not valuation. (abnormalreturns.com)