Are you already signed up for our daily e-mail newsletter? Great, but did you know that we just launched an adviser-focused e-mail on Fridays? Now you do. Sign up here!

Quote of the Day

"Most trading and investment roles will disappear and over time, probably most roles that require human services will be automated...What you will end up with is banks that are run primarily by managers and machines. The managers decide what the machines need to do, and the machines do the job."

(Chris Skinner)

Chart of the Day

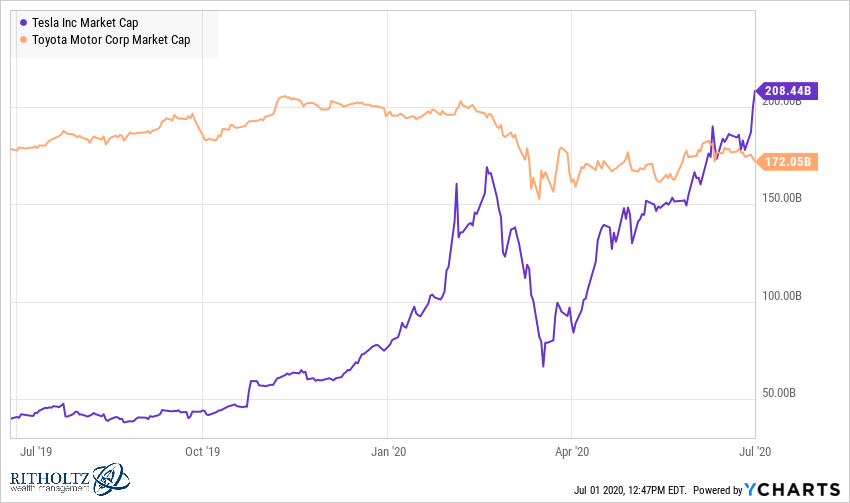

No matter how you slice it, Tesla ($TSLA) is now the world’ most valuable automaker, by market cap. (chart via @ycharts)

Markets

- A review of January 2020 major asset class performance. (capitalspectator.com)

- 2020 has already one of the worst (and best) quarters for the S&P 500 in history. (awealthofcommonsense.com)

- 136 of the S&P 500 stocks are positive year-to-date, not including dividends. (novelinvestor.com)

- 2020 markets are nothing if not unsettled. (basonasset.com)

- Why everyone is talking about gold. (thereformedbroker.com)

- Facebook ($FB) is working hard to convince advertisers to stay on board. (nytimes.com)

- Over 400 companies have joined the Facebook ($FB) boycott. (npr.org)

- What if Facebook (($FB) can't be fixed? (venturebeat.com)

- Like it or not, every company is a media company. (thebasispoint.com)

Finance

- A big fight is brewing between insurers and companies over 'business interruption' coverage in pandemic. (wsj.com)

- Dun & Bradstreet ($DNB) is once again publicly traded. (bloomberg.com)

- Uncle Sam just bought a 29.6% equity stake in trucking company YRC Worldwide ($YRCW). (wsj.com)

- The stock market has rebounded. Why aren't more companies going public? (institutionalinvestor.com)

Funds

- The most over and under-sold benefits of ETFs. (morningstar.com)

- Q1 2020 saw a surge in hedge fund liquidations. (institutionalinvestor.com)

Economy

- ADP said that private payrolls increased by 2.369 million in June. (crossingwallstreet.com)

- The ISM manufacturing index indicated expansion in June. (calculatedriskblog.com)

- Why you can't read too much into economic indicators in this environment. (ftalphaville.ft.com)

Earlier on Abnormal Returns

- Personal finance links: good reasons to sell. (abnormalreturns.com)

- What you missed in our Tuesday linkfest. (abnormalreturns.com)

- Research links: broken strategies. (abnormalreturns.com)

- Sign up for our weekly adviser-focused e-mail that goes on Fridays. Five links to make you think headed into the weekend. (newsletter.abnormalreturns.com)

Mixed media

- Robert Seawright, "Your most dangerous bias is the one you don’t know about." (rpseawright.wordpress.com)

- Three reasons why your decision making is terrible. (markmanson.net)

- Our ability to do risk assessment is shaky, at best. (nytimes.com)

- Chances are you know a lot less than you think you do. (evidenceinvestor.com)

- How to combat hindsight bias. (investornews.vanguard)