Tuesdays are all about academic (and practitioner) literature at Abnormal Returns. You can check out last week’s links including a look at lessons for value investors from previous recessions.

Quote of the Day

"Just because it’s statistically “significant” doesn’t mean it matters. And if it isn’t significant, it may well matter a lot. The next time you come a cross a significant new result, ask yourself if it matters."

(Joachim Klement)

Chart of the Day

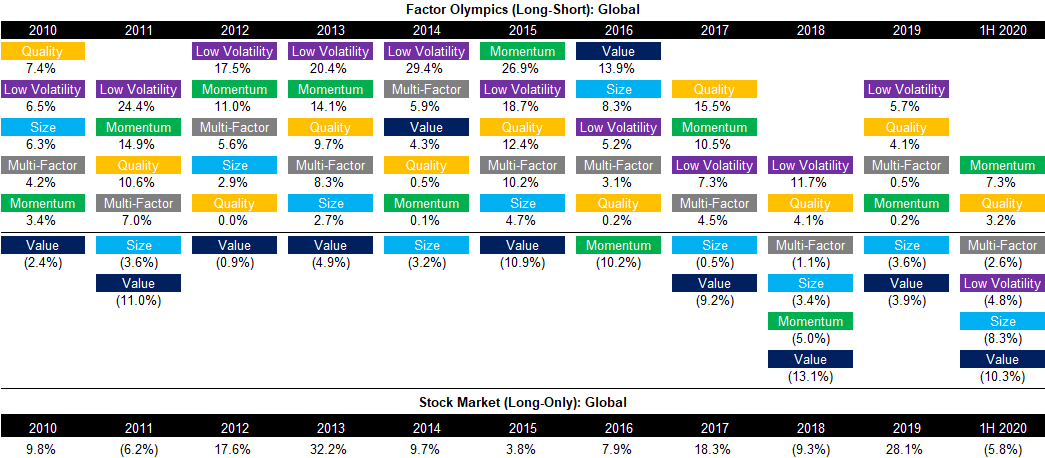

How the factor olympics have played out in the first half of the 2020.

Quant stuff

- A new site to find global factor premia data. (globalfactorpremia.org)

- A round-up of recent business cycle analysis including using ML to forecasting recessions. (capitalspectator.com)

Trend following

- Under what circumstances does trend following create 'crisis alpha'? (alphaarchitect.com)

- Why you want your CTA strategy diversified, but not too much. (mrzepczynski.blogspot.com)

Options

- There's nothing magic about covered call strategies. (evidenceinvestor.com)

- Research shows that following the 'smart money' on CNBC doesn't necessarily pay off. (institutionalinvestor.com)

Behavior

- The 'money doesn't buy happiness' argument is losing some support. (washingtonpost.com)

- Diverse members of corporate boards are less likely to hold leadership positions. (alphaarchitect.com)

Research

- Declarations of a 'broken asset class' often results in a rebound in returns. (researchaffiliates.com)

- Checking back in on the combination of the long term reversal and momentum effects.w (alphaarchitect.com)

- Can we finally write off the price/book ratio for dead? (blog.validea.com)

- The variance risk premium is easy to calculate, hard to implement. (factorresearch.com)

- Please stop comparing hedge funds to the S&P 500. (rcmalternatives.com)

- What explains the increase in corporate payouts in the 2000s? (nber.org)