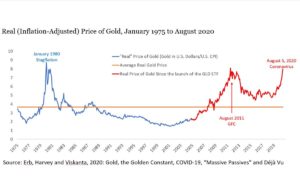

Movie theaters may be closed due to the coronavirus, but that is not preventing Hollywood from working on sequels to many of their hits. The same thing could be said for the gold market which is having a moment. You could call it: ‘Gold 3: The Return of Inflation Expectations.’ You can see below how the price of gold has surged of late, in part, due to expectations about inflation as a result of the Covid-19 pandemic.

This chart is taken from a new paper I have co-authored with Claude Erb and Campbell Harvey entitled “Gold, the Golden Constant, COVID-19, “Massive Passives” and Déjà Vu” which is itself a sequel of sorts. Claude and Cam published a paper called “The Golden Dilemma” back in 2014 which received a Graham and Dodd Scroll from the Financial Analysts Journal and still sits in the Top 100 downloaded papers on SSRN.

The new paper updates the prior findings in light of the pandemic and the increasing importance of the major gold ETFs. The point of the paper isn’t to forecast gold prices, which we show have a mind of their own, separate and apart from inflation. Rather we hope to put the current price of gold into some historical context, show how ETF demand for gold has changed things, and note how Covid-19 has created uncertainty which is likely reflected in gold’s higher price.