Are you already signed up for our daily e-mail newsletter? Great, but did you know that we just launched an adviser-focused e-mail on Fridays? Now you do. Sign up here!

Quote of the Day

"The trouble with analogs is that they can be easily abused. We can find whatever we want to find."

(Jason Goepfert)

Chart of the Day

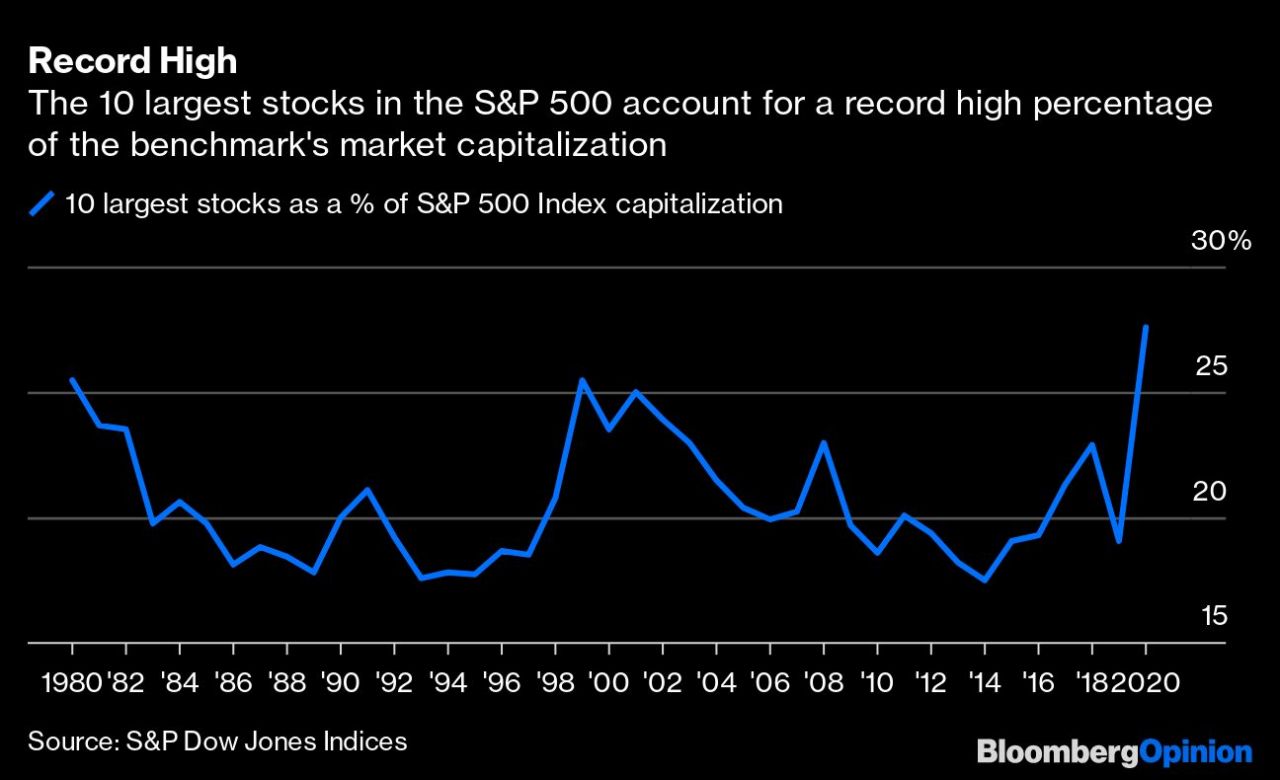

Barry Ritholtz, “It’s not rare for a small group of stocks to account for a large percentage of the S&P 500. What is important is the relative performance of those 10 stocks to the other 490 stocks.”

Markets

- The number of microcap companies in the US has shrunk by half in the past 20 years. (institutionalinvestor.com)

- Emerging market indices look a lot different than they did a decade ago. (awealthofcommonsense.com)

- Country-level valuations depend a lot on sectoral composition. (ftalphaville.ft.com)

Strategy

- Why equity is the 'ultimate asset.' (crossingwallstreet.com)

- We rarely read about the investing cautionary tales. (monevator.com)

Companies

- Uber ($UBER) and Lyft ($LYFT) are considering a change in their business models in California. (nytimes.com)

- Amazon ($AMZN) is expanding its office footprint in six cities. (wsj.com)

- Softbank is parking a chunk of cash in the shares of major tech companies. (finance.yahoo.com)

- American Express ($AXP) is buying Kabbage. (techcrunch.com)

Retail

- Why is Simon Property Group ($SPG) scooping up bankrupt retailers? (ft.com)

- One of these days Walmart+ is actually going to launch. (businessinsider.com)

Housing

- With the system 'maxed out' mortgage lenders are prioritizing purchases over refinancings. (wsj.com)

- Opendoor is resuming its iBuying operations nationwide. (housingwire.com)

- A robust housing market is going to show up in the economic figures moving forward. (bonddad.blogspot.com)

Work

- Location-based pay may be a rabbit hole your company doesn't want to go down. (fastcompany.com)

- Companies are looking to re-imagine the office environment. (wsj.com)

- Is your organization ready for permanent WFM? (hbr.org)

Global

Economy

- John Rekenthaler, "The simplest explanation is also the likeliest: Much of the money created by global governments during this spring and early summer has “leaked” into asset prices." (morningstar.com)

- The economy can't fully recover as long as the coronavirus is widespread. (nytimes.com)

Earlier on Abnormal Returns

- Research links: a massive bet. (abnormalreturns.com)

- What you missed in our Monday linkfest. (abnormalreturns.com)

- Adviser links: questions vs. answers. (abnormalreturns.com)

- Every Friday I send out five links for advisers to help them think a little differently about the world. Sign up now! (newsletter.abnormalreturns.com)

Mixed media

- Ryan Kreuger, "Remember, our job is not to figure it all out. If you feel like pools of digital information are being filled with quicksand, offering little time to breath, before having a chance to separate fact from fiction – you are not alone." (kruegercatalano.com)

- Social media drives a surprisingly small amount of traffic. (ofdollarsanddata.com)

- On the power of morning pages. (rationalwalk.com)