Are you already signed up for our daily e-mail newsletter? Great, but did you know that we just launched an adviser-focused e-mail on Fridays? Now you do. Sign up here!

Quote of the Day

"Real, live, inspiring human energy exists when we coagulate together in crazy places like New York City. Feeling sorry for yourself because you can’t go to the theater for a while is not the essential element of character that made New York the brilliant diamond of activity it will one day be again."

(Jerry Seinfeld)

Chart of the Day

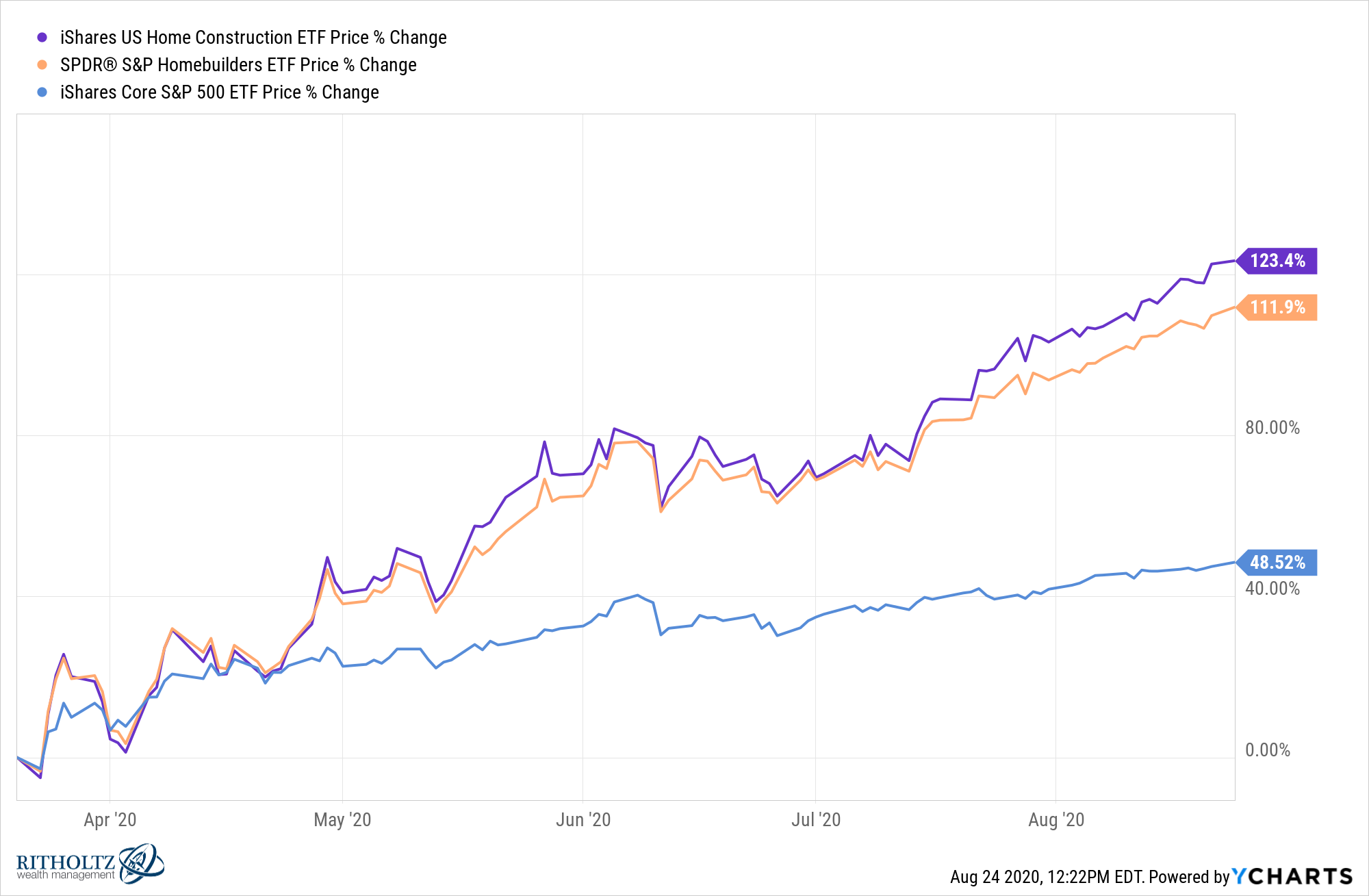

They’re not tech companies, but the homebuilder stocks have been en fuego. (chart via @ycharts)

Markets

- Every bear market (and recovery) is different - especially this one. (awealthofcommonsense.com)

- Global dividends suffered the worst quarterly fall in a decade. (ft.com)

- The correlation between the S&P 500 and its equal-weighted cousin has plummeted. (wsj.com)

- Individuals and newsletter writers disagree about the stock market at present. (sentimentrader.com)

- Short interest is at a record low. (ft.com)

Retail

- Target ($TGT) is thriving in pandemic. Will the ongoing slowdown eventually bite back? (nymag.com)

- Why retail trends could shift again, post-pandemic. (msn.com)

IPOs

- Later this year, Ant Group is likely to set a record for the largest IPO. (wsj.com)

- Lidar company Luminar is going public via SPAC. (techcrunch.com)

Gold ETFs

- How much of the surge in gold is due to ETFs? (wsj.com)

- How much does it cost to vault gold? (msn.com)

Funds

- Is there more left in the 'short malls' trade? (nytimes.com)

- More managers are waiving fees to keep money market fund yields from going negative. (wsj.com)

- Hedge fund incentive fees are skewed toward the manger's favor. (marketwatch.com)

- ETF M&A is heating up. (etf.com)

Global

- Tourist destinations have nothing to fall back on economically in pandemic. (wsj.com)

- US and UK workers are in no rush to return to the office. (ft.com)

Economy

- A look at eight high-frequency economic indicators. (calculatedriskblog.com)

- Small businesses are hunkering down for a longer economic downturn. (axios.com)

- Absent further aid, many households will soon be in dire straits. (washingtonpost.com)

Earlier on Abnormal Returns

- Adviser links: the great unknown. (abnormalreturns.com)

- What you missed in our Sunday linkfest. (abnormalreturns.com)

- The most-read items last week on the site. (abnormalreturns.com)

- Big market moves demand an explanation: the case of gold. (abnormalreturns.com)

- Every Friday I send out five links for advisers to help them think a little differently about the world. Sign up now! (newsletter.abnormalreturns.com)