Mondays are all about financial adviser-related links here at Abnormal Returns. You can check out last week’s links including a look at Schwab’s new free financial planning initiative means for advisers.

Quote of the Day

"There will always be clients who value your services, but that demographic seems to be shrinking."

(Daniel Solin)

Chart of the Day

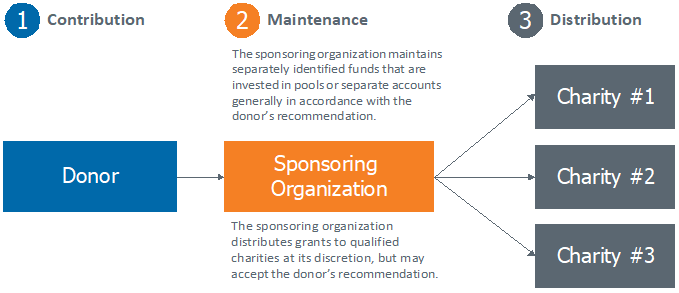

A guide to donor-advised funds: five things to keep in mind.

Podcasts

- Michael Kitces talks with Tiffany Charles who is the chief growth officer for Destiny Capital about carving out a unique career path. (kitces.com)

- Charles Boinske talks with Meir Statman about five myths about diversification and why great financial advisors focus on more than just money. (independenceadvisors.com)

- Justin Castelli talks with Samuel Deane, founder of Deane Wealth Management, about launching a firm early in his career. (justincastelli.io)

- Michael Kitces and Carl Richards talk about two ways advisers can coax clients off the sidelines. (kitces.com)

The biz

- How Charles Schwab ($SCHW) onboarded some 2000 USAA employees during pandemic. (protocol.com)

- Wealth management startups are out of favor with VCs in 2020. (riaintel.com)

- Competition among bidders is making it harder for firms like Focus Financial ($FOCS) to get deals done within their valuation parameters. (riabiz.com)

Accredited investors

- What changed in the new accredited investor rules. (thinkadvisor.com)

- The new accredited investor rules did little to change major objections. (riaintel.com)

Practice management

- Not every financial planning practice is built to sell. (riaintel.com)

- How serving a niche clientele can increase efficiency and income. (kitces.com)

- 'Sell and stay' deals are on the rise. (citywireusa.com)

Money issues

- Financial therapy is growing in popularity among the wealthy. (ft.com)

- How gratitude can help clients better deal with their money issues. (kitces.com)